Introduction

A loan narrative is a crucial element in the world of commercial real estate. It serves as a detailed account that outlines the financial potential and overall value of a property. This narrative goes beyond mere numbers; it tells a compelling story about the investment opportunity.

Understanding the significance of loan narratives is vital for both lenders and borrowers:

- Informed Financing Decisions: Loan narratives empower lenders to evaluate risks and make educated financing choices. For borrowers, crafting an effective narrative can enhance their chances of securing favorable terms.

- Persuasive Communication: Unlike standard loan applications, loan narratives focus on storytelling, making them more engaging and informative.

Harnessing technology can elevate the quality of these narratives. Tools like Hello:Here streamline property searches and assist in creating impactful loan narratives by providing essential data and insights. With Hello:Here, borrowers can leverage comprehensive information to present their properties convincingly, ensuring they stand out in a competitive marketplace.

Additionally, understanding accounting standards like IFRS 16, which transform how leases are recorded in financial statements, can significantly impact real estate transactions.

Moreover, for those exploring different rental strategies, it’s insightful to compare Airbnb Plus vs traditional rentals to understand which might yield better returns.

In multifamily real estate investing, knowing what constitutes a good cap rate can guide investment decisions. Furthermore, conducting a multifamily rent survey can provide valuable insights into rental rates and help property owners make informed decisions.

Lastly, with advancements in technology, the AI property search features offered by platforms like Hello:Here are revolutionizing the real estate industry by making property search and management easier than ever before.

What is a Loan Narrative?

A loan narrative provides a detailed overview of a commercial property and its financial potential, playing a crucial role in commercial real estate transactions. It’s not just a collection of numbers; it’s a compelling story that showcases the value of the investment. By integrating facts, figures, and qualitative insights, borrowers can present a comprehensive picture that appeals to lenders.

Key Aspects of a Loan Narrative

1. Comprehensive Overview

The narrative encapsulates crucial details about the property, including its location, historical performance, and market conditions. This allows lenders to grasp the potential return on investment. For instance, understanding the multiple nuclei model of cities can provide valuable insights into urban development patterns which may influence property values.

2. Financial Potential

Highlighting revenue streams, expense projections, and market trends helps demonstrate the property’s financial viability. Concepts like gain to lease, which refers to the difference between actual rent and potential market rent, can be crucial in this aspect.

Differentiating from Standard Loan Applications

Loan narratives stand apart from standard loan applications in several ways:

- Storytelling Element: Unlike traditional applications that focus solely on quantitative data, loan narratives weave together numbers with storytelling. They engage lenders by painting a vivid picture of the property’s journey and future prospects.

- Persuasive Communication: A well-crafted narrative emphasizes persuasive language. It strategically addresses lender concerns while showcasing strengths and unique selling points.

Incorporating these elements transforms the financing process, enhancing the likelihood of approval by effectively communicating your vision and strategy to lenders. For example, in sectors like multifamily housing or Build-To-Rent (BTR), understanding these dynamics becomes even more crucial for successful loan narratives.

Key Components of an Effective Loan Narrative

Creating a compelling loan narrative requires attention to various key components. Each section serves a specific purpose, ensuring lenders receive a comprehensive understanding of the property and its financial potential.

1. Loan Request Overview

A summary of your loan request should clearly outline:

- Property type

- Location

- Requested amount

- Purpose of the loan

This initial snapshot sets the stage for lenders, allowing them to quickly gauge the essence of your proposal.

2. Property Description

Detail is crucial when describing the property. Highlight:

- Size and condition

- Unique features or amenities

This information captures lender interest and showcases what sets your property apart from others in the market. It’s important to note that certain factors like functional obsolescence can affect property desirability.

3. Location Analysis

Analyzing neighborhood characteristics enhances marketability. Focus on aspects like:

- Accessibility

- Proximity to essential services (e.g., schools, shopping centers)

A well-rounded location analysis can significantly impact perceived value.

4. Market Analysis

Evaluating local real estate trends is vital. Address:

- Demand-supply dynamics

- Historical price trends

Utilizing tools like sentiment analysis can provide valuable insights into market trends, lending credibility to your financial projections and demonstrating informed decision-making.

5. Financial Analysis

Present an overview of:

- Income streams

- Expenses

- Cash flow projections

This section illustrates the investment viability of the property and reassures lenders about its potential returns.

6. Borrower Information

Your financial strength plays a critical role in securing financing. Include:

- Credit history

- Financial statements

A strong borrower profile instills confidence in lenders, facilitating smoother negotiations.

7. Use of Funds

Clearly articulate how you plan to utilize the funds. Specify if they will be used for:

- Purchase

- Refinancing or even exploring options like seller carry back financing which allows buyers to finance their property purchase directly through the seller.

8. Exit Strategy

Discussing repayment strategies is essential for risk mitigation:

- Selling the property

- Refinancing options

Lenders need assurance that you have foresight regarding loan repayment.

9. Risk Assessment

Identify potential risks associated with both the property and market conditions. Consider including:

- Economic factors

- Property-specific risks

Propose mitigation measures to demonstrate proactive planning, especially in areas concerning legal aspects such as indemnity, which plays a crucial role in providing legal protection during property transactions.

10. Supporting Documents

Strengthen your application with relevant documents such as:

- Appraisals

- Lease agreements

Documentation adds weight to your

Common Challenges in Crafting Persuasive Loan Narratives

Creating a compelling loan narrative involves navigating several complexities. Borrowers must effectively communicate the value proposition of their properties while adhering to stringent regulatory requirements. Here are key challenges faced during this process:

1. Complex Regulations

The landscape of commercial real estate financing is marked by various regulatory frameworks. Navigating these intricacies can overwhelm borrowers, leading to narratives that lack clarity or fail to meet compliance standards.

2. Transparency and Disclosure

Lenders prioritize transparency. Omitting critical information can raise red flags, triggering scrutiny and potentially leading to suspicious activity reports. A robust narrative should:

- Clearly outline property details.

- Disclose any potential risks.

- Provide honest assessments of market conditions.

3. Addressing Financial Crimes in Real Estate

Awareness of financial crimes is pivotal. Lenders are increasingly vigilant against money laundering and fraud in commercial transactions. A well-crafted loan narrative must proactively address risks associated with these issues, reassuring lenders of the borrower’s integrity and intent.

4. Crafting a Compelling Story

Beyond facts and figures, a narrative should tell a story that resonates with lenders. Borrowers often struggle to balance technical data with persuasive storytelling elements. It requires skillful integration of:

- Market analysis

- Property history

- Future projections

5. Balancing Detail with Brevity

While thoroughness is vital, excessive detail can dilute the message. Striking a balance between comprehensive information and concise communication is essential for maintaining lender engagement.

Navigating these challenges demands diligence and an understanding of what lenders seek in a loan narrative. By prioritizing transparency and clarity, borrowers can mitigate risks and enhance their chances of securing financing.

Leveraging Technology for Enhanced Loan Narratives

Technology is changing the game in commercial real estate, especially when it comes to creating and analyzing loan narratives. With the help of AI property search and Proptech innovations, borrowers now have the tools to craft more compelling stories that resonate with lenders.

Revolutionizing Creation and Analysis Phases

1. Data Aggregation

Traditional methods of gathering property data can be time-consuming and fragmented. Advanced technologies streamline this process, allowing borrowers to access comprehensive information quickly.

2. Enhanced Accuracy

AI-driven platforms minimize human error by providing accurate, real-time data. This reliability strengthens the credibility of loan narratives, making them more persuasive.

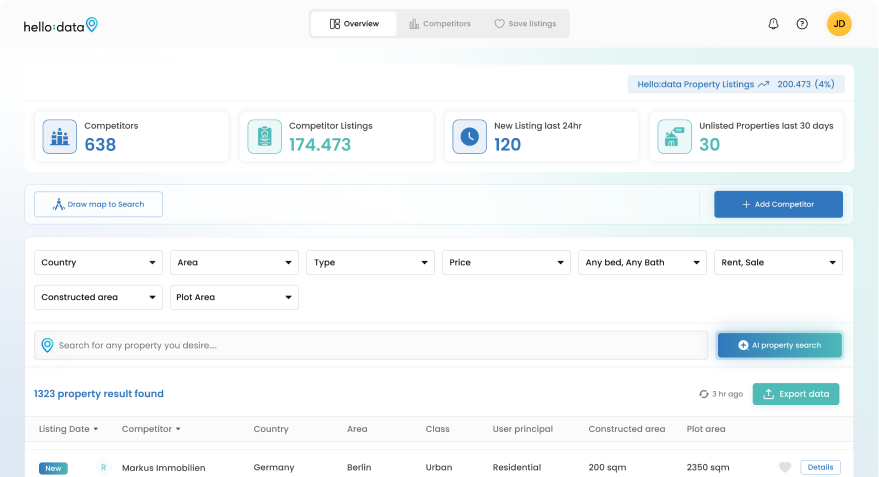

Hello: Here’s AI-Driven Solutions

Introducing Hello:Here, an innovative app designed to revolutionize property data aggregation. With its Hello Data Property Tracking feature, users gain access to:

- Extensive Property Listings: Surpassing competitors like Idealista, Hello Data boasts 82k properties in areas like Mallorca compared to the mere 24k from larger platforms.

- Efficient Matching Algorithms: Borrowers benefit from a streamlined process that matches property details with lender requirements effectively.

This technology empowers borrowers to construct stronger loan narratives effortlessly. By leveraging precise data and insights, they can showcase their properties’ financial potential convincingly.

Examples of Impact

When using tools like Hello:Here, borrowers can include relevant statistics and insights directly into their narratives:

- Market trends

- Comparable property performance

- Financial forecasts

These elements enrich the narrative, allowing lenders to visualize the property’s value proposition clearly.

The era of cumbersome data collection is fading. With AI-enhanced solutions at our disposal, creating effective loan narratives becomes a more manageable task. As we embrace these advancements, the potential for securing financing increases significantly.

Real-Life Examples Demonstrating The Power Of Well-Crafted Loan Narratives

Effective loan narratives are not just paperwork; they are powerful tools that can secure financing for various types of commercial properties. Here are a few compelling examples:

1. Office Building Financing

A borrower seeking a loan for a newly renovated office building in a bustling urban area presented a detailed loan narrative. The narrative highlighted the property’s strategic location, tenant stability, and strong market demand. By incorporating data on local employment rates and economic growth, which underscored the role of economic base in real estate investments, the borrower successfully secured a $5 million loan from a major bank.

2. Retail Space Acquisition

In another instance, a retail entrepreneur aimed to acquire a shopping center. The loan narrative emphasized the center’s existing lease agreements with reputable tenants, projected cash flow, and plans for revitalization. This storytelling approach resonated with lenders, leading to approval of a $3 million commercial real estate loan.

3. Multifamily Development Project

A developer aspiring to construct a multifamily housing complex crafted a persuasive narrative focusing on community needs and demographic trends. The narrative included market research showing an increasing demand for housing in the area. By leveraging SFR analytics tools to provide precise data on these trends, lenders recognized the project’s potential, resulting in financing of over $10 million.

Through these examples, the significant impact of well-crafted loan narratives becomes clear. They not only present data but also convey the vision and opportunity behind each project. This approach enhances credibility and fosters trust with lenders, ultimately facilitating successful financing outcomes across diverse commercial real estate ventures.

Best Practices For Writing Compelling Loan Narratives That Stand Out To Lenders

Crafting a persuasive loan narrative can significantly impact your success in qualifying for commercial loans. Here are essential practices to ensure your narrative captures lender attention positively:

1. Clarity is Key

Use straightforward language. Avoid jargon and complex terms that could confuse readers. Aim for simplicity while conveying critical information.

2. Thoroughness Matters

Each section should be well-developed. Don’t leave lenders guessing about important details. Provide comprehensive insights into property history, financial performance, and market conditions.

3. Structure Your Narrative

- Introduction: Briefly outline the property and its potential.

- Financial Overview: Present clear financial statements and projections.

- Market Analysis: Discuss the local market landscape, trends, and competition.

4. Highlight Unique Selling Points (USPs)

What makes your property stand out? Focus on features like location advantages, recent renovations, or tenant stability that differentiate it from others on the market.

5. Leverage Technology

Utilize innovative tools like Hello:Here to gather data efficiently. The AI-driven app can aggregate relevant property information, enhancing the quality of your narrative with accurate data and insights.

6. Visual Aids

Include charts, graphs, and images where appropriate. Visual elements can effectively convey complex information quickly and make your narrative more engaging.

7. Risk Mitigation Strategies

Address potential risks upfront. Discuss how you plan to mitigate these risks to reassure lenders of your preparedness and foresight.

8. Be Authentic

Maintain a genuine tone throughout your narrative. Authenticity builds trust and showcases your commitment to the project.

By adhering to these best practices, you create a compelling loan narrative that resonates with lenders. This approach not only fosters confidence but also enhances the chances of securing financing for your commercial real estate endeavors.

Conclusion

Understanding loan narratives is crucial for anyone looking to secure financing in the commercial real estate sector. Well-crafted loan narratives play a pivotal role in:

- Clearly communicating value: Lenders appreciate narratives that effectively showcase a property’s potential and financial viability.

- Building trust: Transparency and thoroughness foster confidence in borrowers, making lenders more inclined to approve loans.

- Enhancing competitiveness: In a crowded market, a compelling narrative can differentiate your proposal from others.

The benefits of commercial real estate loans extend beyond mere funding; they represent opportunities for growth and innovation. Leveraging advanced tools like Hello:Here, which streamline the process of finding the perfect property with its advanced AI property search capabilities, allows borrowers to construct powerful narratives that resonate with lenders.

Emphasizing clarity, structure, and strategic insights within your loan narrative can significantly improve your chances of success. With the right approach, securing financing becomes not just a possibility but an achievable goal.