Introduction

What is a HUD 221(d)(4) loan? This specialized financing option is designed to support the development of multifamily real estate projects, particularly those aimed at creating affordable housing. It plays a crucial role in the real estate market by providing developers with favorable terms that can enhance project viability and sustainability.

Key features of HUD 221(d)(4) loans include:

- Long-term financing for the construction and permanent phases.

- Government backing, which reduces risks for lenders and investors.

- Support for affordable housing initiatives, addressing critical housing shortages.

This guide will provide you with a comprehensive understanding of HUD 221(d)(4) loans, including:

- Features that set these loans apart

- Eligibility criteria for applicants

- Application process step-by-step

- Advantages and challenges involved

- How technology like Hello Here can assist you in leveraging these loans effectively for your multifamily housing projects.

To empower yourself with knowledge about HUD 221(d)(4) loans and discover how they can be instrumental in driving innovation and growth in the affordable housing sector, it is also essential to stay updated on real estate news. You can find some of the best sources of real estate news in 2024 through platforms like Hello Here.

Additionally, understanding certain key concepts in real estate can further enhance your ability to make informed decisions. For instance, conducting a Comparative Market Analysis, which helps determine the value of a property by analyzing data from recently sold properties with similar characteristics, could be beneficial.

Moreover, if you’re looking to optimize your investment strategies, it’s crucial to understand the Gross Income Multiplier (GIM) in real estate. The GIM serves as a quick valuation metric that helps property investors assess potential income against the property’s price.

Finally, as we delve deeper into the realm of Artificial Intelligence (AI), it’s important to grasp the difference between Black Box AI and Explainable AI (XAI) models. Understanding these key differences could significantly impact your approach towards AI tools used in real estate.

By familiarizing yourself with these resources and concepts, you’ll be better equipped to navigate the complexities of the multifamily housing sector and leverage HUD 221(d)(4) loans effectively.

Understanding HUD 221(d)(4) Loans

Definition and Purpose

HUD 221(d)(4) loans, backed by the Department of Housing and Urban Development (HUD), are designed to finance the construction and substantial rehabilitation of multifamily rental housing. This program promotes affordable housing development by providing long-term financing options for developers. These loans serve as a vital tool in addressing the pressing need for quality, affordable housing across urban landscapes.

Historical Context

The evolution of HUD 221(d)(4) loans reflects changing priorities in the real estate market. Initially established in the mid-20th century, this financing option aimed to stimulate post-war housing construction. Over the decades, adjustments have been made to meet contemporary challenges such as rising construction costs and increasing demand for affordable living spaces. The program has adapted to incorporate stricter regulatory standards and a focus on sustainability, ensuring that it remains relevant in today’s market.

Key Stakeholders

Several key players contribute to the success of HUD 221(d)(4) loans:

- Borrowers: Typically developers or property owners seeking financing for multifamily projects. Experience in managing similar projects enhances their eligibility.

- Lenders: FHA lenders facilitate the loan process, working closely with borrowers to ensure compliance with HUD guidelines. They play a crucial role in assessing risk and underwriting loans.

- Government Agencies: The Department of Housing and Urban Development oversees the program’s regulations and ensures that funds are allocated towards projects that effectively serve communities.

Understanding these components is essential for navigating the complexities of HUD 221(d)(4) loans. With this knowledge, developers can harness these financial resources to contribute meaningfully to affordable housing initiatives within their communities.

Additionally, it’s worth noting that some areas designated as Opportunity Zones may present unique investment prospects under this loan scheme. These zones offer significant tax incentives for investing in economically distressed areas, making them an attractive option for developers seeking funding through HUD 221(d)(4) loans.

Furthermore, leveraging advanced SFR analytics tools can enhance decision-making processes for borrowers by providing precise and actionable data essential for making informed investment decisions.

In addition to understanding the financial aspects of these loans, it’s crucial for developers to grasp certain real estate metrics such as breakeven occupancy, which represents the minimum occupancy level required for a property to cover its operating expenses and debt service without incurring losses.

Moreover, familiarizing oneself with innovative payment solutions like ClickPay, designed specifically for the real estate industry, can simplify financial management tasks such as collecting rent.

Lastly, understanding liquidity in real estate, which refers to how quickly and easily a property can be bought or sold without significantly impacting its price, is also important when considering investments in multifamily properties financed through HUD 221(d)(4) loans.

Key Features and Financing Potential of HUD 221(d)(4) Loans

HUD 221(d)(4) loans are structured to support multifamily housing development through a clear framework that encompasses both construction and permanent financing. Understanding the intricacies of this loan type is crucial for maximizing its potential.

Loan Structure and Terms

- Duration: These loans typically cover a period of 40 years, with an initial phase dedicated to construction followed by a transition to permanent financing. This Waterfall model in project management is often utilized during the construction phase, ensuring a smooth and efficient process.

- Conversion Process: Upon completion of the construction phase, the loan converts to a permanent mortgage. This seamless transition is vital in managing project costs efficiently.

Interest Rates and Cash Flow Impact

During the construction phase, interest rates are generally lower, creating an interest-only period. This arrangement allows developers to focus on project completion without the burden of full repayment. The impact on cash flow can be substantial:

- Lower initial payments

- Enhanced liquidity for operational expenses

- Opportunity to reinvest savings back into the project

Financing Percentages for Property Types

The HUD 221(d)(4) program offers varying financing percentages based on property classification:

- Market-Rate Properties: Typically receive up to 85% financing.

- Affordable Housing: Can secure up to 90% financing, encouraging developers to create economically accessible units.

- Subsidized Properties: May qualify for even higher percentages, reflecting federal support for housing initiatives.

This tiered approach allows developers to leverage their investments effectively while addressing community needs.

In summary, HUD 221(d)(4) loans provide a robust financial tool for multifamily housing projects. Understanding the loan structure, interest rate benefits during construction, and financing percentages enhances a developer’s ability to make informed decisions that align with their goals.

Eligibility Criteria and Application Process for HUD 221(d)(4) Loans

Understanding who can apply for HUD 221(d)(4) loans is essential. Here’s a breakdown of the borrower requirements:

1. Experience

Applicants must demonstrate significant experience in multifamily development or management. This ensures they have a grasp of the market dynamics and operational challenges. For instance, having knowledge about how market segmentation is revolutionizing real estate with AI could be beneficial.

2. Single-Asset Entities

Typically, loans are extended to single-asset entities. This means that the borrower is often a company specifically created to manage the property being financed.

3. Local Government Support

Securing backing from local government is crucial. This support not only enhances loan eligibility but also provides assurance to lenders regarding project viability.

The application process involves several steps and required documentation:

- Preliminary Assessment: Prospective borrowers should conduct an initial review of their project’s feasibility, including financial projections and market studies. Understanding the Multiple Nuclei Model of cities could provide valuable insights during this phase.

- Documentation Collection: Key documents include:

- Market studies to validate demand.

- Property appraisals to establish value.

- Detailed construction plans outlining project scope and timelines.

- Application Fees: Be prepared for application fees, which vary by lender and can impact your budget.

- Submission: Once all documents are compiled, submit them to an approved HUD lender for assessment.

- Timeline Expectations: The review process can take several months. Patience is essential as thorough evaluations ensure compliance with HUD regulations.

Navigating these eligibility criteria and the application process can be complex but understanding each step paves the way for successful financing under the HUD 221(d)(4) program.

Regulatory Compliance in HUD Financing Projects

Developers using HUD 221(d)(4) financing need to understand and follow various regulations. Following federal rules is essential for the success of their projects. Here are the key areas they need to focus on:

1. Wage Standards

According to the Davis-Bacon Act, developers must pay workers on federally funded projects the wages that are commonly paid in the area. This law aims to ensure fair pay and can affect project budgets and schedules.

2. Labor Laws

Developers must follow federal labor laws, which include rules about employee rights, workplace safety, and overtime pay. Knowing these laws is important to avoid legal issues that could slow down the project.

3. Environmental Regulations

Projects need to meet environmental requirements to minimize harm to nearby communities. This involves getting necessary permits and conducting environmental assessments as required by the National Environmental Policy Act (NEPA).

4. Reporting Requirements

Developers must keep detailed records and submit regular reports showing that they are following all relevant regulations. If they fail to do this, they may face penalties or lose funding.

Meeting these compliance requirements requires careful attention and effort. Working with experienced legal and financial advisors can make this process smoother, ensuring that developers follow the rules while focusing on completing their projects. Understanding the importance of these regulations not only reduces risks but also improves developers’ reputation in the multifamily housing market.

Advantages, Challenges & Types Comparison in Using a HUD 221(d)(4) Loan

Leveraging HUD 221(d)(4) loans presents several advantages for developers and investors focused on multifamily housing projects. Key benefits include:

- Long-Term Mortgage Insurance Benefits: These loans are backed by mortgage insurance, providing financial stability that attracts investors. This coverage reduces risk, facilitating smoother project financing and enhancing overall affordability in the housing market.

- Affordability in Housing Market: The availability of these loans encourages the development of affordable housing options. Developers can offer lower rents, making projects more appealing to tenants and positively impacting community growth.

Despite the advantages, applicants face challenges during the loan process. Common pitfalls include:

- Prepayment Penalties: Some loan terms may carry prepayment penalties, which can impact financial planning. Understanding these penalties is crucial for maintaining cash flow throughout the project lifecycle.

- Interest Rate Premiums: Interest rates can vary significantly based on the project’s risk profile. Applicants must evaluate how these rates affect overall costs and returns on investment.

Different types of HUD loans cater to varying needs within the real estate market. Notably:

- HUD 223(f): This loan type is designed for refinancing existing multifamily properties without requiring significant renovations. It’s ideal for stabilized properties looking to secure favorable financing terms.

- HUD 221(d)(4): Best suited for new construction and substantial rehabilitation projects, this loan type supports developers through both the construction phase and permanent financing transition.

Understanding these distinctions allows borrowers to select the most appropriate financing option based on their specific project requirements and goals. Balancing the benefits against potential challenges ensures informed decision-making in navigating HUD financing opportunities.

Additionally, it’s important to consider the economic base of a region when making real estate investments as it drives financial stability and growth. Furthermore, understanding concepts like gain to lease can provide valuable insights into property valuation and rental pricing strategies. Lastly, innovative technologies such as AI property search are revolutionizing the real estate industry by streamlining property search processes and improving accessibility for potential buyers or renters.

The Role Of AI Technologies In Real Estate Financing And How Hello Here Helps

The real estate industry is rapidly changing, thanks to AI property search innovations. Hello Here SL has positioned itself at the forefront of this transformation with its cutting-edge property tracking app. This technology is designed to streamline the property search process, enhancing user experience through efficient property matching.

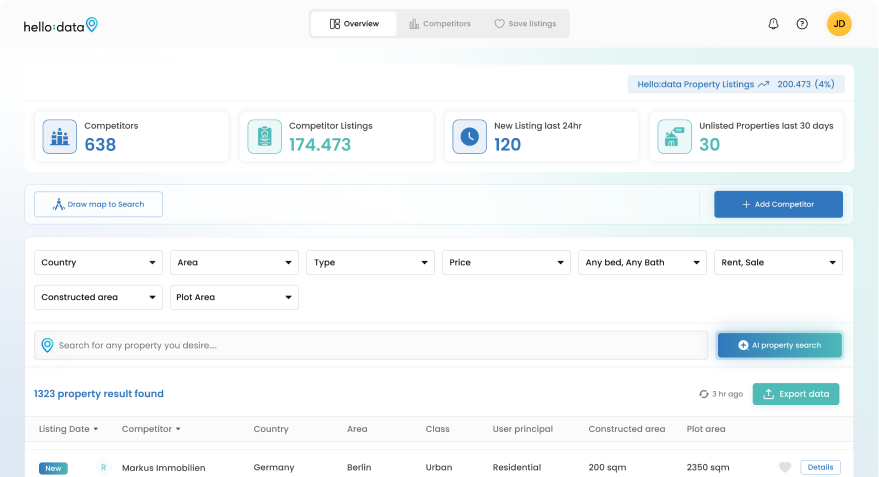

Key Features of Hello Here

1. Intelligent Property Matching

The app utilizes algorithms similar to dating apps, allowing users to find properties that align with their specific preferences and needs. This personalized approach saves time and increases the likelihood of finding the ideal multifamily housing project.

2. AI-Generated Content

By leveraging AI-generated content, Hello Here enhances the quality of listings, providing detailed insights that empower users to make informed decisions. From market trends to property specifications, users gain a comprehensive view of their options.

3. Aggregated Data Tracking

Hello Here’s platform surpasses traditional sites like Zillow by generating and aggregating real estate data more effectively. It boasts four times more listings than competitors—82k properties in Mallorca compared to 24k on Idealista—ensuring users have access to a broader range of opportunities.

Advantages of Using Hello Here

1. Targeted Searches

The app addresses gaps in targeted search capabilities, making it easier for developers and investors to find suitable financing options and properties that meet HUD 221(d)(4) criteria.

2. Global Reach

With an initial market focus worldwide, Hello Here aims to revolutionize both US and global real estate markets. Its ambitious goal is rooted in harnessing AI for unmatched property matching efficiency.

Incorporating AI into real estate financing is not just a trend; it’s a necessity for staying competitive in today’s market. As we continue exploring HUD 221(d)(4) loans, understanding how platforms like Hello Here can enhance the financing process becomes increasingly vital.

Moreover, the use of advanced Support Vector Machines, a powerful artificial intelligence tool, is revolutionizing real estate by solving classification problems and improving property matching accuracy.

Additionally, understanding concepts like RUBS, which refers to the Ratio Utility Billing System used in multifamily properties, can greatly impact investment decisions. It’s also crucial to comprehend the as stabilized value in real estate investments, which estimates the value of a property once it has reached its optimal condition.

Lastly, having knowledge about different property valuation methods such as the cost approach in real estate appraisal can further aid investors in making informed decisions.

Conclusion: Leveraging Technology For Better Financing Strategies With A Focus On HUD 221(d)(4) Loans And Hello Here’s Support

Understanding HUD 221(d)(4) loans opens doors to a wealth of opportunities for multifamily housing projects. The blend of traditional financing methods with innovative technologies, such as those provided by Hello Here, can transform your approach to securing these vital funds.

Consider the following benefits:

- Streamlined Processes: Technology-enhanced resources like Hello Here simplify the journey of navigating loan approvals, allowing for faster and more efficient outcomes.

- Informed Decisions: Access to comprehensive data analytics empowers you to make better financial choices, reducing risks associated with funding.

- Enhanced Property Matching: Hello Here’s AI-driven capabilities ensure you find suitable properties swiftly, maximizing your investment potential.

Embracing these tools will not only clarify the complexities surrounding HUD 221(d)(4) loans but also position you for success in your multifamily housing ventures. As the real estate landscape evolves, leveraging technology will be essential in overcoming challenges and unlocking the benefits of HUD financing. Explore how Hello Here can support your journey towards achieving your real estate goals while understanding the nuances of what a HUD 221(d)(4) loan truly offers.

Moreover, it’s important to recognize the growing significance of submetering in multifamily real estate, a trend that is gaining traction among investors seeking innovative ways to enhance property management. Understanding multifamily housing and its relation to the Build-To-Rent (BTR) concept will further inform your investment strategies. Additionally, leveraging geospatial analysis can significantly improve property sales outcomes. Lastly, as we move into 2024, it’s crucial to understand how AI is changing rental listings, which could provide valuable insights into future market trends.