Introduction

Indemnity in real estate plays a crucial role in providing legal protection during property transactions. This concept involves agreements that shift risk and liability between parties, ensuring that potential losses are managed effectively. Understanding indemnity is essential for buyers, sellers, landlords, and tenants.

Key aspects of indemnity include:

- Protection against unforeseen liabilities

- Risk mitigation strategies tailored to specific transactions

- Assurance that responsibilities are clearly defined

As the real estate landscape evolves, innovative solutions like Hello:Here leverage Artificial Intelligence (AI) technology to enhance the efficiency of indemnity agreements. For instance, Hello:Here’s AI-driven platform offers advanced data tracking capabilities that help investors and agents navigate complex property transactions with ease. This system is not just limited to indemnity agreements but also revolutionizes the entire AI property search process, making it easier for users to find and manage properties.

The integration of AI empowers users to make informed decisions, minimizing risks associated with legal disputes and environmental concerns. Moreover, understanding concepts like breakeven occupancy and liquidity in real estate can further equip buyers and investors with the knowledge needed for successful property dealings.

In addition, as we delve deeper into the realm of AI in real estate, it’s important to distinguish between Black Box AI and Explainable AI (XAI), which are crucial in understanding how these technologies operate. Furthermore, with AI’s influence extending to rental listings as well, knowing how technology is changing rental listings can provide additional insights into the evolving real estate landscape.

Understanding what indemnity in real estate entails not only equips you with knowledge but also positions you for success in the dynamic world of property dealings.

Understanding Indemnity in Real Estate Transactions

Indemnity refers to a legal concept where one party agrees to compensate another for any losses or damages incurred. In real estate transactions, indemnity agreements play a crucial role in defining responsibilities and protecting the interests of all parties involved.

Relevance of Indemnity in Real Estate

Indemnity is vital in real estate because it establishes a mechanism for shifting risk and liability among buyers, sellers, landlords, and tenants. These agreements clarify who bears the financial burden when problems arise during or after a property transaction.

Shifting Risk and Liability

When engaging in property deals, indemnity clauses serve to:

- Protect against unforeseen circumstances.

- Allocate responsibility for specific risks.

- Ensure that one party does not unfairly shoulder liabilities.

For instance, if a buyer discovers a title defect post-purchase, an indemnity agreement can stipulate that the seller is responsible for rectifying this issue. Such clauses help mitigate potential disputes and provide a clear pathway for compensation.

Common Scenarios for Indemnity Application

Several scenarios illustrate where indemnity agreements are commonly applied in real estate:

- Title Defects: If a title search reveals unresolved claims against the property, an indemnity clause can protect the buyer from financial loss.

- Environmental Issues: Property transactions often involve environmental assessments. If contamination is discovered later, the seller may be required to indemnify the buyer for remediation costs.

Understanding these fundamental aspects of indemnity enriches your knowledge of real estate transactions. As you navigate the complexities of property dealings, recognizing how indemnity agreements function empowers you to make informed decisions while safeguarding your investments.

Moreover, it’s essential to comprehend other aspects such as RUBS (Ratio Utility Billing System), which is a method used to allocate utility costs among tenants in multifamily properties. Additionally, understanding the as stabilized value in real estate investments can aid in making informed decisions. Familiarizing yourself with various property valuation methods is also crucial in the ever-evolving landscape of real estate. Finally, staying updated on market trends through the best sources of real estate news is vital for making informed decisions.

Types of Indemnity Clauses Used in Real Estate Contracts

Indemnity clauses are crucial components of real estate contracts, serving to allocate risk and protect parties involved. Understanding the types of indemnity clauses can empower you in negotiations and help mitigate potential liabilities.

Common Types of Indemnity Clauses

- General Indemnity: This clause provides broad protection, requiring one party to compensate the other for losses or damages incurred, regardless of fault. For instance, a seller may agree to indemnify the buyer against any claims arising from property defects that existed before the sale.

- Limited Indemnity: As the name suggests, this clause restricts the scope of indemnification. It may apply only to specific situations or limit the amount recoverable. An example would be a landlord agreeing to indemnify a tenant only for damages arising from negligence on the landlord’s part.

- Third-Party Indemnity: This type addresses claims made by external parties. For example, if a contractor sues a property owner for unpaid work, an indemnity clause might obligate the owner to cover legal expenses incurred by the contractor.

Mutual and No-Fault Indemnity Clauses

- Mutual Indemnity: In this arrangement, both parties agree to indemnify each other for specific losses. This is often seen in joint ventures where both investors seek protection against potential risks associated with property development.

- No-Fault Indemnity: Here, one party agrees to indemnify another without regard to fault. For example, if an environmental issue arises from a property transaction, the seller might bear full responsibility for remediation efforts, irrespective of whether they were negligent or not.

Incorporating Advanced Technologies in Real Estate Transactions

Understanding these types allows you to craft robust agreements tailored to your needs and risks in real estate transactions. Each clause serves a distinct purpose aimed at protecting your interests while facilitating smoother transactions between parties involved.

In addition to understanding these clauses, leveraging advanced technologies can further streamline real estate transactions. For instance, platforms like Clickpay, which simplify rent collection and financial management, can be extremely beneficial.

Moreover, adopting strategies such as submetering in multifamily properties can enhance property management efficiency and tenant satisfaction.

Furthermore, utilizing AI-driven platforms like Hello Here can revolutionize property searches by providing more accurate and efficient results.

Lastly, understanding concepts like gain to lease can provide valuable insights into optimizing rental income based on market trends.

The Importance of Indemnity Agreements for Buyers, Sellers, Landlords, and Tenants

Indemnity agreements serve as a vital tool in risk management in real estate. They establish clear expectations and responsibilities among parties involved in a transaction. Here’s how they contribute significantly to the process:

1. Risk Mitigation

Indemnity agreements are designed to protect all parties—buyers, sellers, landlords, and tenants—from unforeseen liabilities. By clearly defining who is responsible for specific risks, these agreements minimize potential disputes. For example, if a tenant damages a property, an indemnity clause can specify whether the landlord or the tenant bears financial responsibility.

2. Preventing Disputes

Well-drafted indemnity provisions act as a safeguard against future litigation. Clarity in terms ensures that all parties understand their obligations and rights. This understanding can prevent conflicts down the line. A seller might agree to indemnify the buyer for any title defects discovered after the sale. Such provisions directly address potential issues before they escalate into costly legal battles.

3. Flexibility in Agreements

Indemnity agreements can be tailored to meet specific needs of various stakeholders. Landlords can include clauses that cover environmental issues which may arise during tenancy. Buyers can negotiate terms that protect them from undisclosed liens on a property. This adaptability enhances the effectiveness of risk management strategies.

4. Boosting Confidence

Knowing that risks are effectively managed through indemnity agreements instills confidence in all parties involved. Buyers feel more secure making investments, while sellers gain peace of mind knowing they are protected against potential claims post-sale.

Understanding the importance of indemnity agreements is crucial for navigating real estate transactions successfully. With precise drafting and clear communication, these agreements become powerful tools for safeguarding interests and fostering trust among stakeholders.

In addition to indemnity agreements, leveraging data-driven strategies can further enhance decision-making in real estate transactions. For instance, utilizing SFR analytics tools can provide precise and actionable data that is crucial for making informed investment decisions.

Moreover, understanding the role of economic base is essential as it drives financial stability and growth in a region which significantly impacts real estate investments.

Lastly, exploring options like real estate syndications, which involve private securities offerings filed with the U.S. Securities and Exchange Commission (SEC), can also open up new avenues for investment and risk management in real estate.

Legal Considerations When Drafting Enforceable Indemnity Agreements

Drafting an enforceable indemnity agreement requires careful attention to several legal aspects. Understanding these considerations is critical to avoid pitfalls that could jeopardize the agreement’s effectiveness.

Key Legal Aspects to Consider

- Compliance with State Laws: Each state has unique regulations governing indemnity agreements. It’s essential to be familiar with these laws to ensure compliance. Some states may have specific requirements regarding the language used or limitations on the scope of indemnification.

- Public Policy Principles: Certain indemnity provisions may not be enforceable if they contradict public policy. For example, agreements that attempt to indemnify a party for their own negligence may face challenges in court, as many jurisdictions do not permit such arrangements. Ensuring that provisions align with public interests is crucial for enforceability.

Potential Challenges

- Ambiguity in Terms: Vague language can lead to disputes about the intent and scope of indemnification. Precise definitions and clear terms are vital for minimizing misunderstandings.

- Limitations on Liability: Some agreements impose caps on recoverable damages which can affect the overall risk allocation between parties. These limitations must comply with applicable laws and should be clearly articulated within the agreement.

- Exclusions from Coverage: Identifying what is not covered by indemnification is equally important. Parties should explicitly outline exclusions to prevent any future legal complications.

Focusing on these key legal considerations will enhance the robustness of indemnity agreements, ensuring they serve their intended purpose while protecting all parties involved in real estate transactions effectively.

Best Practices for Drafting Effective Indemnity Agreements in Real Estate Deals

Creating a strong indemnity agreement is crucial for protecting your interests during property transactions. Here are practical tips to guide you through the process:

1. Use Clear Language

Precision is vital. Ambiguity can lead to disputes. Every term should be clearly defined. Avoid jargon unless it is widely understood within the industry.

2. Identify Parties Clearly

Specify who is involved in the agreement. Clearly define roles and responsibilities of each party to avoid confusion.

3. Outline Scope of Indemnity

Clearly state what liabilities are covered. This includes damages, losses, or claims arising from specific situations, such as title defects or environmental issues.

4. Include Limitations and Exclusions

Highlight any limitations on indemnification. For example, you might specify that indemnification does not cover negligence on the part of the indemnified party.

5. Negotiate Terms Thoroughly

Engage in open discussions about terms before finalizing your agreement. Negotiate to ensure that all parties feel comfortable with their obligations and rights under the indemnity clause.

6. Consider State Laws

Be aware of local laws impacting indemnity agreements. Different jurisdictions may have unique requirements or restrictions that could affect enforceability.

7. Seek Legal Guidance

Involve legal professionals experienced in real estate law to review your draft. Their expertise can help identify potential pitfalls and ensure compliance with relevant legislation.

Effective indemnity agreements serve as critical safeguards in real estate transactions, minimizing risks associated with unforeseen liabilities. Clear language, thorough negotiation, and a solid understanding of applicable laws enhance the strength of these agreements, promoting smoother transactions and reducing potential disputes among parties involved.

Limitations and Potential Drawbacks Associated with Indemnification Provisions in Real Estate Contracts

Indemnification agreements serve as a crucial component in mitigating risks within real estate transactions. However, several limitations may arise that could affect their effectiveness.

Common Limitations of Indemnity Agreements

- Monetary Caps on Damages

- Many indemnity clauses include caps on recoverable damages. These caps can significantly limit the financial protection an indemnified party might expect in case of a loss. For instance, if a property suffers extensive damage due to undisclosed issues, a cap might restrict recovery to a predetermined amount, leaving significant costs uncovered.

- Scope of Indemnification

- Often, indemnity agreements define the scope of obligations too narrowly. This limitation can lead to gaps where certain types of losses or liabilities are not covered. Parties must ensure that the terms encompass all potential risks associated with the transaction to avoid being left vulnerable.

- Exclusions and Limitations

- Certain indemnity agreements may exclude specific scenarios from coverage, such as negligence or willful misconduct. These exclusions place parties at risk if they encounter situations that fall outside the indemnity’s protective umbrella.

Potential Drawbacks of Relying Solely on Indemnification

- False Sense of Security

- Parties relying solely on indemnification as their primary means of risk mitigation may develop a false sense of security. They might overlook other critical strategies for managing risks, such as comprehensive insurance policies or thorough due diligence before closing deals.

- Enforceability Issues

- Some indemnity provisions may face challenges regarding enforceability under state laws or public policy principles. If an agreement is deemed unenforceable, the intended protections evaporate, potentially exposing parties to unforeseen liabilities.

Broader Implications in Real Estate

Understanding these limitations and drawbacks allows participants in real estate transactions to approach indemnification with caution and awareness. This is particularly relevant in sectors like Multifamily Housing and Build-To-Rent (BTR), where the complexities of contracts may increase.

Moreover, the landscape is changing with advancements such as AI-driven market segmentation, which allows for more tailored and effective risk management strategies beyond mere reliance on indemnity clauses. Taking proactive steps ensures comprehensive risk management strategies that go beyond mere reliance on indemnity clauses.

Enforcing Indemnity Agreements: Steps to Take When Disputes Arise

Enforcing indemnity agreements can be complex. Here are critical steps to follow when a dispute arises:

1. Review the Agreement

- Examine the specific terms of the indemnity clause.

- Identify the scope of indemnification and the obligations of each party.

2. Gather Evidence

- Collect all relevant documentation, including correspondence and any incident reports.

- Ensure that evidence substantiates your claim for indemnification.

3. Communicate with the Other Party

- Initiate dialogue to address concerns directly.

- Clarify positions and explore potential resolutions before escalating matters.

4. Seek Legal Counsel

- Consult with a legal expert specialized in real estate law.

- Understand your rights and obligations under state laws and regulations.

5. Consider Mediation or Arbitration

- Explore alternative dispute resolution methods to avoid lengthy litigation.

- These avenues can provide a less adversarial environment for resolving disputes.

6. File a Legal Claim if Necessary

- If informal negotiations fail, consider initiating a legal proceeding.

- Ensure that all statutory requirements for filing are met.

Common Challenges During Enforcement

Several challenges may arise during enforcement efforts:

- Ambiguity in Language: Misinterpretation of terms can hinder enforcement. Clear definitions within the agreement mitigate this risk.

- Jurisdictional Issues: Different states have varying laws regarding indemnity agreements. Understanding these nuances is essential for proper enforcement.

- Public Policy Considerations: Some indemnity clauses may be deemed unenforceable due to public policy restrictions. Assessing compliance with local regulations is crucial.

Strategies for Overcoming Challenges

Here are some strategies to overcome challenges during enforcement:

- Draft Carefully: Use precise language in indemnity agreements to avoid ambiguity.

- Stay Informed on Legal Changes: Regularly review changes in laws affecting indemnity provisions to remain compliant.

- Establish Strong Communication Channels: Encourage open communication between parties involved to facilitate swift resolutions and minimize conflicts.

By following these steps and addressing challenges proactively, you can enhance your chances of successfully enforcing indemnity agreements in real estate transactions.

Addressing Environmental Liability Concerns Through Indemnification: A Case Study Example

Environmental liability poses significant risks in real estate transactions. Proactive measures are essential to mitigate these risks effectively. Indemnification mechanisms serve as critical tools for addressing environmental concerns, ensuring that parties are protected from potential liabilities arising from past or present contamination issues.

Why Indemnification is Crucial

Indemnification plays a vital role in managing environmental risks during real estate transactions. Here are three key reasons why it is crucial:

- Risk Mitigation: Indemnity clauses can shift the financial burden of environmental liabilities from one party to another, providing peace of mind.

- Encouraging Diligence: Buyers and sellers are motivated to conduct thorough environmental due diligence when indemnity is at stake.

- Preserving Value: Properly structured indemnity agreements safeguard property value by addressing potential cleanup costs or legal fees associated with environmental damage.

Case Study: VFC Partners 26 v. Cadlerocks Centennial Drive

In this notable case, the parties faced significant environmental concerns related to soil contamination on a commercial property. The seller, Cadlerocks Centennial Drive, was liable for historical contamination issues that surfaced post-sale.

Key Elements of the Indemnity Clause:

- Clear Definition of Responsibilities: The indemnity clause explicitly outlined the seller’s obligation to bear costs related to environmental remediation.

- Scope of Liability: It included third-party claims arising from contamination, ensuring comprehensive protection for the buyer.

- Limitations and Conditions: Specific conditions were set for invoking the indemnity, balancing risk exposure between both parties.

As a result of this well-drafted indemnity agreement, VFC Partners successfully transferred the risk associated with environmental liabilities back to Cadlerocks. This case underscores how strategic use of indemnification can effectively manage environmental risks in real estate transactions, facilitating smoother deals while safeguarding investments.

The Role of Technology in Streamlining Risk Management Processes For Investors And Agents In The Real Estate Market

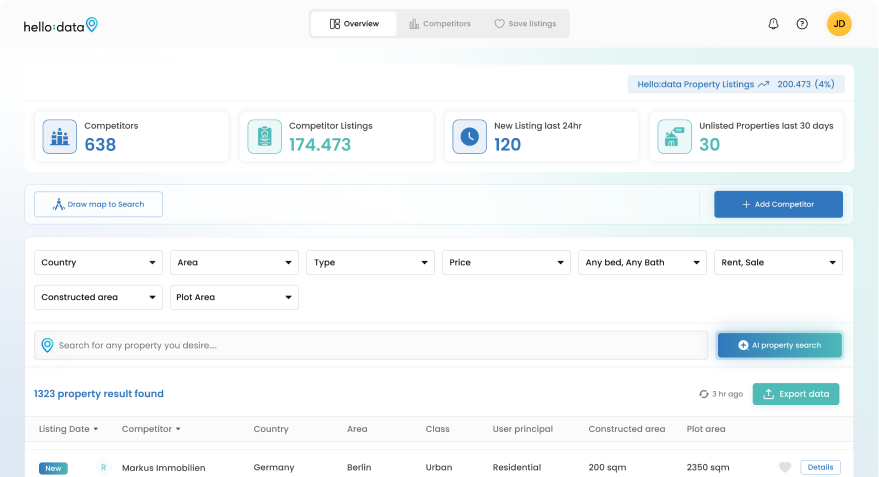

Hello:Here is changing the real estate industry with its AI-powered solutions for property searches, listings, and risk management. This innovative platform makes indemnity agreements more efficient, simplifying complex transactions.

Key features of Hello:Here that assist investors and agents include:

- Hello Data Property Tracking: An advanced data aggregation tool that surpasses traditional platforms like Idealista, providing four times more listings. This capability allows users to identify potential risks associated with properties quickly.

- AI Property Search: Simplifies the property search process much like a dating app, matching investors with ideal properties based on specific criteria. It reduces time spent on research and increases accuracy in identifying suitable investments.

- Real-time Data Insights: Enables agents and investors to access up-to-date market information, ensuring informed decision-making. Enhanced data tracking capabilities empower them to manage risks proactively.

Using technology like Hello:Here not only simplifies risk management but also ensures a more efficient way to handle the complexities of real estate transactions. By using these advanced tools, stakeholders can focus on growth while effectively reducing potential liabilities.

Moreover, Support Vector Machines, a fundamental part of artificial intelligence, are being utilized to solve classification problems in real estate by finding the best boundary that separates different property types.

In addition, geospatial analysis is emerging as a game-changer in real estate, using geographical data and mapping techniques to analyze properties and land effectively.

Furthermore, understanding concepts such as Opportunity Zones can provide significant tax incentives for investors in economically distressed areas.

Additionally, mastering tools like Comparative Market Analysis can help real estate investors determine the value of a property by analyzing data from recently sold properties with similar characteristics.

Lastly, grasping the concept of Gross Income Multiplier (GIM) is crucial for property investors looking to optimize their investment strategies as it serves as a quick valuation metric that helps assess the potential profitability of a property.

Conclusion

Understanding indemnity in real estate is crucial for anyone engaging in property transactions.

Key takeaways include:

- Protection: Indemnity agreements provide essential legal protection, helping to mitigate risks associated with property dealings.

- Technology Integration: Leveraging modern technologies like Hello:Here can streamline the process, making it easier and faster to manage indemnity agreements. The app’s AI-driven solutions enhance efficiency in risk management, ensuring that you stay informed and protected. This integration of technology into real estate is akin to the Waterfall model in project management, which ensures a sequential and organized approach to project phases.

- Expert Guidance: Seeking expert advice when drafting or enforcing indemnity agreements is vital. Professionals can help navigate the complexities of these contracts, ensuring they are robust and enforceable.

By prioritizing a thorough understanding of indemnity and utilizing advanced tools such as Hello:Here, investors, buyers, sellers, landlords, and tenants can confidently engage in real estate transactions. This proactive approach not only safeguards your interests but also paves the way for successful ventures in the dynamic property market.

Stay informed. Stay protected.

Additionally, understanding urban development models like the Multiple Nuclei Model can also provide valuable insights for real estate investors and stakeholders.