Introduction

The income approach in real estate appraisal is a critical concept for investors and property owners. This method focuses on evaluating income-producing properties, determining their value based on the revenue they generate.

Key points to understand include:

- The income approach assesses properties primarily through their ability to produce cash flow.

- It is essential for making informed investment decisions, especially in rental markets.

- A solid grasp of this approach allows stakeholders to analyze property performance effectively.

An emerging trend is the integration of Artificial Intelligence in real estate appraisal. AI tools enhance data analysis, streamline processes, and offer deeper insights into market trends, providing a competitive edge. For instance, AI technology is transforming real estate and property management through automated pricing and seamless tenant matching. As technology evolves, mastering the income approach will empower investors to navigate the complexities of property valuation with confidence and precision.

Understanding this approach is not just beneficial; it is essential for success in the ever-changing landscape of real estate investment. A key aspect of this understanding involves recognizing the as stabilized value of a property, which refers to its estimated worth once it has reached its optimal operational state.

Moreover, comprehending terms such as ingress and egress can significantly impact property accessibility and thus its valuation. It’s also important to be aware of regulatory frameworks like Regulation D, which can influence real estate investments by providing exemptions for companies to raise capital without extensive registration.

In this rapidly evolving landscape, distinguishing between different types of AI models such as Black Box AI and Explainable AI (XAI) becomes crucial. While black box models are powerful, they operate without transparency, making it difficult to understand their decision-making process. On the other hand, XAI models offer more clarity and insight into their functioning.

Leveraging these insights and understanding the various factors influencing real estate appraisal will provide stakeholders with a comprehensive perspective necessary for making informed decisions in their investment journey.

Understanding the Income Approach

Income-producing properties are real estate assets that generate revenue through rental income. These properties include:

- Residential rental units: Apartments, single-family homes, and multi-family buildings.

- Commercial properties: Office buildings, retail spaces, and industrial warehouses.

- Mixed-use developments: Spaces that combine residential, commercial, and recreational uses.

When assessing property value, several valuation methods are commonly employed in real estate:

- Income Approach: Focuses on the revenue potential of a property. It is particularly relevant for income-producing properties as it provides a clear picture of expected cash flows.

- Cost Approach: Determines value based on the cost to replace or reproduce the property minus depreciation. This approach may not adequately reflect market demand for income-generating assets.

- Comparison Approach: Evaluates property value by comparing it to similar properties that have recently sold. This method can sometimes overlook unique income potential.

The income approach holds significant importance in valuing properties that generate rental income. It enables investors and property owners to make informed decisions based on projected revenues rather than just market trends or replacement costs. By understanding this valuation method, stakeholders can better assess their investments and identify opportunities for growth in their portfolios.

Understanding these concepts lays the groundwork for deeper exploration into key components such as Net Operating Income (NOI) and capitalization rates, which drive effective investment strategies.

In parallel, sentiment analysis has emerged as a valuable tool for understanding market trends in real estate. This process involves analyzing opinions and emotions expressed in text from various sources like social media and news articles to gain insights into market dynamics.

Moreover, changes in accounting standards like IFRS 16, which significantly impacts leasing practices in the real estate sector, are crucial to comprehend for anyone involved in this field.

For those considering different rental models, an analysis of Airbnb Plus vs traditional rentals can provide useful insights into their respective advantages and disadvantages.

Furthermore, leveraging SFR analytics tools can enhance real estate insights by providing precise and actionable data essential for making informed investment decisions.

Lastly, understanding metrics such as breakeven occupancy, which represents the minimum occupancy level required for a property to cover its operating expenses and debt service without incurring losses, is critical for successful real estate investment.

Key Components of the Income Approach

Understanding Net Operating Income (NOI) is critical for evaluating property performance. NOI represents the total income generated from a property minus all operating expenses. This metric provides a clear picture of how effectively a property is generating income after accounting for costs.

Calculating NOI

To calculate NOI, follow this step-by-step approach:

- Determine Gross Rental Income: This includes all revenue from rents and other sources. A multifamily rent survey can be instrumental in understanding how rental rates work.

- Subtract Operating Expenses: These encompass property management fees, maintenance costs, property taxes, insurance, and utilities.

The formula can be summarized as:

NOI = Gross Rental Income – Operating Expenses

Capitalization Rate (Cap Rate)

The capitalization rate (cap rate) serves as a crucial indicator in real estate valuation. It expresses the relationship between NOI and the property’s market value, revealing how investors assess potential returns.

The formula for calculating cap rate is:

Cap Rate = NOI / Market Value

A lower cap rate indicates higher property values and vice versa. This inverse relationship signifies that as cap rates decrease, property values increase, highlighting the importance of understanding both metrics when making investment decisions.

By mastering these components—NOI and cap rates—you empower yourself to make informed evaluations of income-producing properties. Through precise calculations and analysis, you unlock the potential for strategic investment opportunities.

Additionally, conducting a Comparative Market Analysis (CMA) can further enhance your understanding of property values by analyzing data from recently sold properties with similar characteristics.

Moreover, with advancements in technology such as Artificial Intelligence, the way we buy, sell, and manage properties is undergoing a transformation. Embracing these changes through platforms like Hello:Here, which utilize AI for property search and management, can significantly streamline your investment process.

Understanding these key components and leveraging modern technology will equip you with the tools needed to excel in the real estate market.

Appraisal Methods within the Income Approach

The income approach offers various appraisal methods tailored to specific property scenarios. Two prominent methods are the direct capitalization method and the yield capitalization method.

Direct Capitalization Method

This method is ideal for properties with stable, predictable income. It involves:

- Estimating Net Operating Income (NOI): This provides a snapshot of annual income, which can include revenue from platforms like Clickpay, designed specifically for the real estate industry.

- Applying a Capitalization Rate (Cap Rate): The formula is straightforward: [ \text{Market Value} = \frac{\text{NOI}}{\text{Cap Rate}} ]

Use this method when you expect consistent cash flows, such as in apartment buildings or commercial properties with long-term leases.

Yield Capitalization Method

In contrast, the yield capitalization method considers multiple years of cash flows and potential changes in rental rates. It’s more complex yet invaluable for properties with fluctuating incomes. Key aspects include:

- Forecasting Future Cash Flows: Recognizes that income can change due to market conditions.

- Discounting Future Income: Uses a discount rate to present the value of future cash flows in today’s terms.

This method suits long-term investments where income stability is uncertain, such as newly developed properties or those undergoing significant changes. For example, understanding the role of economic base can be crucial in making these predictions more accurate.

Both methods empower investors to make informed decisions tailored to their unique investment strategies and risk tolerance. Additionally, with the rise of technology and AI in real estate, as discussed in this article on how technology is changing rental listings, investors now have access to more tools and resources than ever before. This includes sectors like multifamily housing, which are becoming increasingly popular due to their potential for consistent income streams.

Calculating Property Value Using the Income Approach

To accurately calculate property value using the income approach, follow this straightforward formula:

Market Value = NOI / Cap Rate

Step-by-Step Guide

1. Determine Net Operating Income (NOI)

- Start with your total gross rental income.

- Subtract operating expenses, which include management fees, maintenance costs, insurance, property taxes, and utilities.

Example: If your gross rental income is $100,000 and total operating expenses are $30,000:

NOI = $100,000 – $30,000 = $70,000

2. Identify the Capitalization Rate (Cap Rate)

The cap rate reflects the expected return on investment and varies by market conditions and property type.

Example: If comparable properties in the area have a cap rate of 8%, use this figure.

3. Apply the Formula

Plug your numbers into the formula:

Market Value = NOI / Cap Rate

Market Value = $70,000 / 0.08 = $875,000

Key Considerations

- The accuracy of your calculations relies heavily on precise data for both NOI and cap rate.

- Regularly update your figures to adapt to market fluctuations.

- This method provides a clear snapshot of property value based on its income-generating potential.

By mastering these steps, you empower yourself to make informed decisions about real estate investments. Understanding how to effectively calculate property value allows for strategic planning and enhanced financial outcomes.

Additionally, leveraging advanced technologies such as AI Property Search can streamline the process of finding rental units that fit your investment criteria. This technology not only simplifies the search but also enhances the overall efficiency of real estate transactions.

Furthermore, it’s crucial to understand liquidity in real estate, which refers to how quickly a property can be bought or sold without significantly impacting its price. High liquidity indicates a fast-moving market, where properties are sold quickly and at expected prices. Understanding these dynamics will further equip you in making strategic real estate decisions.

Factors Affecting Property Value in the Income Approach

Understanding the factors affecting property value is essential for accurate assessments in the income approach. Several key elements play a crucial role in determining a property’s worth:

1. Vacancy Rate

A high vacancy rate can significantly diminish rental income. Properties with consistent occupancy often command higher values due to predictable cash flows. Investors must analyze historical vacancy trends to gauge future performance.

2. Operating Costs

Operating expenses directly impact Net Operating Income (NOI). Higher costs reduce NOI, leading to lower property values. Key operating costs include:

- Property management fees

- Maintenance and repairs

- Utilities

- Insurance and taxes

Attention to detail in budgeting these costs can enhance operating efficiency and maximize property value.

3. Location

Location remains a timeless factor. Properties in desirable neighborhoods attract premium rents, increasing their overall value. Accessibility to amenities, schools, and public transport can enhance rental demand.

4. Market Conditions

Economic shifts can influence rental rates and occupancy levels. Understanding market trends helps investors anticipate changes that may affect property performance.

5. Property Condition

The physical state of a property affects its appeal and rental potential. Regular maintenance and upgrades can sustain or enhance value, while neglect can lead to depreciation.

Incorporating these factors into your analysis supports more informed investment decisions, ensuring you capture the true potential of income-producing properties. Recognizing the importance of operating efficiency allows investors to navigate challenges effectively while optimizing returns.

Comparison with Other Appraisal Methods

Understanding the distinctions between different appraisal methods is crucial for making informed decisions in real estate. Here’s a closer look at two primary approaches: the cost approach and the sales comparison approach.

Cost Approach vs. Income Approach

- Cost Approach: This method evaluates property value based on the cost to replace or reproduce the property minus depreciation. It’s particularly useful for unique properties or new constructions where limited comparable sales data exists.

- Income Approach: Focused on income-generating potential, this approach estimates value based on expected future cash flows. It is preferred for investment properties, such as apartment buildings or commercial spaces, where rental income is a primary consideration.

When to choose:

- Use the cost approach for newly built properties or special-use buildings.

- Opt for the income approach when dealing with established rental properties with predictable income streams.

Sales Comparison Approach vs. Income Approach

The sales comparison approach evaluates value by comparing similar properties that have recently sold.

- Benefits:

- Provides a straightforward way to assess market value.

- Reflects current market conditions through actual sale prices.

- Limitations:

- Requires sufficient comparable sales data, which may not always be available.

- Less effective for unique or rental-focused properties.

In contrast, the income approach offers a more detailed analysis of an investment’s potential return, making it invaluable for investors seeking data-driven insights into profitability and risk management. Knowing when to apply each method enhances your appraisal strategy and aligns it with specific property scenarios.

Just like in project management where methodologies such as the Waterfall model provide structured approaches to achieving goals, understanding these appraisal methods can lead to better decision-making in real estate investments.

The Role of Technology in Real Estate Appraisal

The integration of AI in real estate valuation transforms traditional appraisal methods, enhancing accuracy and efficiency. Key advancements include:

- Data Aggregation: AI streamlines the collection and analysis of vast data sets, providing appraisers with up-to-date market trends and property performance metrics.

- Predictive Analytics: Machine learning algorithms analyze historical data to forecast future property values, helping investors make informed decisions.

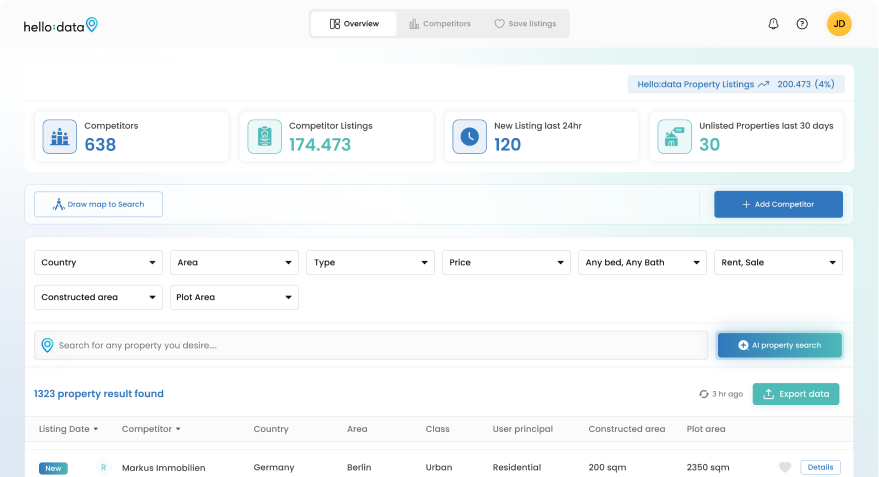

A prime example of innovation in this space is Hello Here, a cutting-edge Proptech company. Leveraging AI, Hello Here specializes in:

- AI Property Search: Simplifying the property search process for users by matching their preferences with available listings.

- AI Listing Optimization: Enhancing visibility and relevance of properties through intelligent data analysis.

By utilizing advanced technologies like Support Vector Machines, Hello Here stands out in the crowded real estate market, offering brokers and investors a powerful tool for effective decision-making. The company’s commitment to revolutionizing the real estate landscape not only addresses existing gaps but also sets a new standard for efficiency and insights in property valuation.

This technological shift empowers appraisers to harness rich data insights, ultimately leading to more accurate valuations and better investment outcomes. Additionally, staying updated on the latest real estate news is crucial for making informed decisions as the market evolves rapidly influenced by economic shifts, policy changes, and emerging technologies. Furthermore, tools such as geospatial analysis have emerged as game-changers in maximizing home sales by using geographical data and mapping techniques. Lastly, understanding concepts like Opportunity Zones can provide significant tax incentives for investors looking into economically distressed areas.

Conclusion

Mastering the income approach in real estate appraisal is essential for both investors and brokers. This method allows us to accurately assess the value of income-producing properties.

Key points to remember:

- Understanding the income approach empowers informed investment decisions.

- It focuses on Net Operating Income (NOI) and capitalization rates (cap rates), which are crucial for evaluating property performance.

By leveraging this knowledge, we can navigate the complexities of real estate valuation with confidence. The insights gained from understanding this approach enhance our ability to maximize investment returns and make strategic decisions.

As we look ahead, embracing innovative tools and technology will further elevate our expertise in the market. These advancements ensure that we remain competitive and well-prepared for future opportunities.

Stay committed to your growth in mastering this pivotal aspect of real estate appraisal. Understanding what the income approach encompasses will set you apart in making impactful investments.