Introduction

IFRS 16 is a groundbreaking accounting standard that transforms how leases are recorded in financial statements.

This standard significantly impacts the real estate sector, altering leasing practices for landlords, lessors, and lessees alike.

Understanding the implications of IFRS 16 on real estate leasing is crucial for industry professionals seeking to navigate the complexities of financial reporting.

As we delve deeper into this topic, we will highlight Hello:Here as a case study. This innovative platform leverages Artificial Intelligence to streamline property listings, demonstrating how technology can facilitate adherence to these evolving accounting standards while enhancing the home-selling process.

For instance, understanding as stabilized value in real estate investments is crucial for making informed decisions. Additionally, staying updated on the best sources of real estate news can greatly aid industry professionals in navigating market changes.

Moreover, comprehending concepts like opportunity zones and utilizing tools such as a Comparative Market Analysis can provide significant advantages in the real estate sector. Lastly, the rise of AI property search is changing the way renters and landlords navigate the real estate market, making the property search process easier and more efficient.

Understanding IFRS 16 and Its Key Components

Definition and Purpose of IFRS 16

IFRS 16, introduced by the International Accounting Standards Board (IASB), has transformed lease accounting. The main goal is to improve transparency in financial reporting by requiring lessees to recognize most leases on their balance sheets. This change helps stakeholders gain a clearer understanding of a company’s financial obligations, making it easier to compare businesses.

Key Changes from IAS 17 to IFRS 16

Transitioning from IAS 17 to IFRS 16 brings significant changes in lease recognition requirements:

- Lessees: Under IAS 17, leases were classified as either operating or finance leases. Only finance leases appeared on the balance sheet, while operating leases were kept off-balance, leading to potential misrepresentation of liabilities.

- IFRS 16 mandates: Lessees must now recognize a right-of-use asset and a lease liability for all leases longer than 12 months, fundamentally altering how companies account for leasing transactions.

Right-of-Use Assets and Lease Liabilities

At the core of IFRS 16 are two important components:

- Right-of-Use Asset (ROU):

- Represents the lessee’s right to use an underlying asset throughout the lease term.

- Initially measured at cost, including:

- Lease liability

- Initial direct costs

- Estimated dismantling costs

- Lease Liability:

- Reflects the present value of future lease payments.

- Measured at the discounted value of remaining lease payments using the interest rate implicit in the lease, if available; otherwise, the lessee’s incremental borrowing rate is used.

Breakdown of Lease Payments Under IFRS 16

Lease payments consist of various components that impact financial statements:

- Fixed payments

- Variable lease payments tied to an index or rate

- Amounts expected to be paid under residual value guarantees

- Purchase options if likely to be exercised

The recognition of these elements leads to increased asset and liability figures on balance sheets, resulting in altered financial ratios and performance metrics.

Understanding these key aspects of IFRS 16 equips real estate professionals with critical insights for navigating leasing practices in a compliant manner. Embracing this knowledge prepares you for the evolving landscape shaped by stringent accounting standards. With technology like Hello:Here streamlining data management and enhancing sentiment analysis for better market trend understanding, adapting becomes not only feasible but also advantageous as we move forward into a new era of real estate leasing practices.

Applying IFRS 16 to Real Estate Transactions

Understanding the implications of IFRS 16 for real estate transactions is essential. The standard fundamentally alters how landlords, lessors, and lessees account for leasing contracts. Here’s a closer look at specific impacts:

Implications for Different Parties

1. Landlords and Lessors

- Under IFRS 16, landlords must recognize lease payments as income on their financial statements.

- This requires a shift in how rental income is recorded, moving from an operating lease classification to recognizing right-of-use assets.

2. Lessees

- Lessees face increased financial obligations due to the recognition of lease liabilities and corresponding right-of-use assets.

- This change enhances transparency regarding future cash flows and liabilities on their balance sheets.

Impact on Financial Statements

The transition to IFRS 16 brings significant changes in financial reporting:

1. Balance Sheet

- Both lessees and lessors will see an increase in total assets and liabilities.

- Right-of-use assets and lease liabilities will be reported, impacting key financial ratios such as debt-to-equity ratios.

2. Income Statement

- Lessees will report depreciation on the right-of-use asset and interest expenses related to lease liabilities.

- For lessors, lease income will be recognized in a manner that may affect revenue recognition patterns.

Income Reporting Changes

The accounting treatment under IFRS 16 leads to notable shifts in income reporting:

- Lessees experience front-loaded expenses, with higher costs in the earlier years of the lease period.

- Landlords benefit from clearer visibility into their rental income streams but must adjust their accounting practices accordingly.

Navigating these changes requires a thorough understanding of how leasing contracts are structured and reported. As industry professionals adapt to these new standards, technology solutions can facilitate compliance and streamline processes. For instance, AI technology is transforming real estate and property management by automating pricing and tenant matching, setting new industry standards as seen with platforms like Hello:Here which are revolutionizing property search through AI-driven solutions.

Navigating Lease Classification Challenges Under IFRS 16

Understanding lease classification is crucial for adapting to the new requirements of IFRS 16. The shift from IAS 17 to IFRS 16 brought significant changes in how leases are categorized, which directly impacts financial reporting.

Major Differences in Lease Classification

Under IAS 17, leases were classified as either:

- Finance leases: Treated as purchases of assets, where risks and rewards of ownership transferred to the lessee.

- Operating leases: Treated as rental agreements, where no asset or liability was recognized on the balance sheet.

With IFRS 16, almost all leases must be recorded on balance sheets. Key distinctions include:

- Right-of-use (ROU) assets and lease liabilities must be recognized for nearly all contracts that meet the definition of a lease.

Practical Example

Consider a retail company leasing a storefront for five years. Under IAS 17, this agreement might have been classified as an operating lease, with rental expenses reported in the income statement. Now, under IFRS 16:

- The company records an ROU asset representing its right to use the property.

- A corresponding lease liability reflects its obligation to make lease payments.

This change enhances transparency but complicates financial statements, making it essential for stakeholders to grasp the implications fully.

Evolution of Contract Evaluation

The implementation of IFRS 16 has transformed contract evaluation practices. Companies must examine lease contracts more rigorously to determine whether they qualify as leases under the new standard. This involves:

- Assessing whether a contract grants control over an identified asset.

- Evaluating terms for options, such as renewal or termination, that can affect classification.

These evaluations require collaboration across finance teams and legal advisors ensuring compliance and accurate reporting.

The migration from IAS 17 to IFRS 16 represents not just a technical accounting change but also a fundamental shift in how organizations approach lease obligations and their financial implications.

In light of these changes, it’s interesting to note how technology is revolutionizing rental listings and impacting lease agreements in real estate. The use of AI in property search is making it easier for businesses to find suitable locations that meet their needs while also complying with the new IFRS standards. This AI property search technology is just one example of how technology is changing the landscape of real estate and leasing.

Complex Arrangements and COVID-19 Considerations in Lease Accounting

Complex lease arrangements present unique challenges under IFRS 16, particularly with sale-and-leaseback transactions and sub-leases. Understanding how these arrangements are treated can significantly impact financial reporting and compliance.

Sale-and-Leaseback Transactions

A sale-and-leaseback transaction occurs when an entity sells an asset and simultaneously leases it back. Under IFRS 16, the seller-lessee must assess whether the lease represents a finance or operating lease.

The accounting treatment depends on whether the transfer of ownership is classified as a sale. If it is considered a sale, the entity recognizes a gain or loss on the sale while also recognizing right-of-use assets and lease liabilities for the leaseback.

Sub-Leases

For sub-leases, lessees acting as lessors must evaluate the terms of their original lease against the sub-lease agreement.

The classification of a sub-lease as either finance or operating affects how income is recognized and reported in financial statements. The original lessee’s obligations under the primary lease remain intact even when sub-leasing.

COVID-19 Impact

The COVID-19 pandemic brought unprecedented changes to lease agreements and financial reporting practices. Key considerations include:

- Rent Concessions: Many businesses faced financial strain, leading to negotiations for rent concessions. IFRS 16 allows lessees to account for rent modifications as they occur, simplifying adjustments to their lease liabilities.

- Modifications of Leases: Changes in lease terms due to economic hardship require careful evaluation. Entities must determine whether modifications should be treated as new leases or if existing terms need adjustment.

Navigating these complexities requires a comprehensive understanding of IFRS 16’s provisions. As organizations adapt to evolving circumstances, ensuring compliance while maximizing financial insight becomes essential for success in real estate accounting.

Understanding the economic base is crucial for real estate investments, as it drives financial stability and growth in a region. Additionally, advancements like AI property search are revolutionizing how properties are found and leased, making the process more efficient amidst these challenging times.

Implementing IFRS 16 Effectively: Steps for Successful Compliance

Adapting to IFRS 16 requires a strategic approach. Companies in the real estate sector must prioritize effective implementation to ensure compliance and maintain financial integrity. Here are practical steps to guide this transition:

1. Assessment of Current Leases

Conduct a comprehensive inventory of all lease agreements. Understand the terms and conditions of each lease to assess their impact under IFRS 16.

2. Training Financial Teams

Invest in training resources for finance teams. Equip them with the knowledge necessary to navigate the complexities of IFRS 16, including lease classification and reporting requirements.

3. Utilizing Technology

Leverage accounting software solutions specifically designed for IFRS 16 compliance. These tools can streamline data collection, facilitate accurate calculations, and enhance reporting efficiency.

4. Developing New Policies

Establish updated accounting policies that reflect the changes brought by IFRS 16. Ensure these policies are integrated into daily operations to align with new standards.

5. Continuous Monitoring and Review

Regularly review lease agreements and financial statements. Adapt processes as necessary to accommodate any future changes in leasing practices or regulations.

By embracing these steps, companies can effectively implement IFRS 16, ensuring compliance while positioning themselves for growth in the evolving real estate landscape.

How Hello: Here is Transforming Real Estate with IFRS 16 Compliance

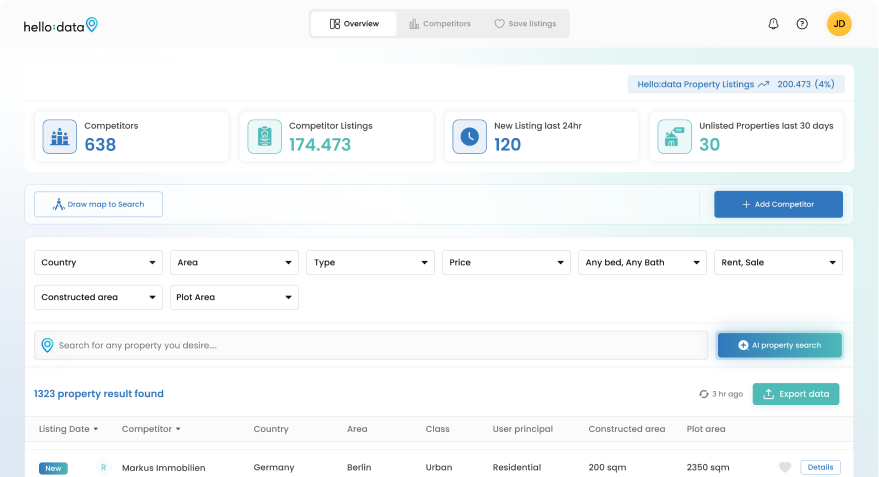

Hello:Here is changing the real estate industry by using AI technology to improve property listings in line with the new accounting rules set by IFRS 16. With AI integrated into property searches, the process becomes smoother and real estate professionals can easily meet compliance requirements.

Key benefits of using Hello:Here include:

- Enhanced Property Listings: AI-driven algorithms curate and present listings more effectively, providing users with tailored options that meet their specific needs.

- Improved Compliance: Platforms like Hello:Here simplify adherence to IFRS 16 regulations by offering tools that track lease agreements and financial reporting seamlessly.

- Economic Efficiency: By optimizing property search processes, Hello:Here reduces time spent on manual data entry and analysis, leading to cost savings for firms adapting to new standards.

The shift towards Proptech solutions signifies a future where technology empowers real estate transactions. Understanding what is IFRS 16 and how it applies to real estate becomes easier with innovative platforms like Hello:Here, ensuring professionals can stay ahead in a competitive market while maintaining compliance with evolving regulations.

Moreover, Hello:Here utilizes advanced techniques such as geospatial analysis to maximize home sales by analyzing geographical data and mapping techniques. This is just one example of how technology is being harnessed in the real estate sector.

Furthermore, as the industry adapts to these changes, understanding key concepts such as ingress and egress becomes crucial for both property owners and buyers. These concepts significantly impact property accessibility and value.

In this rapidly evolving world of Artificial Intelligence (AI), it’s also important to grasp the difference between Black Box AI and Explainable AI (XAI) models, as discussed in our article on Black Box vs. Explainable AI (XAI). Understanding these key differences can significantly impact how we leverage AI in real estate.