Understanding the Distinction between Cash to Close and Closing Costs in Real Estate

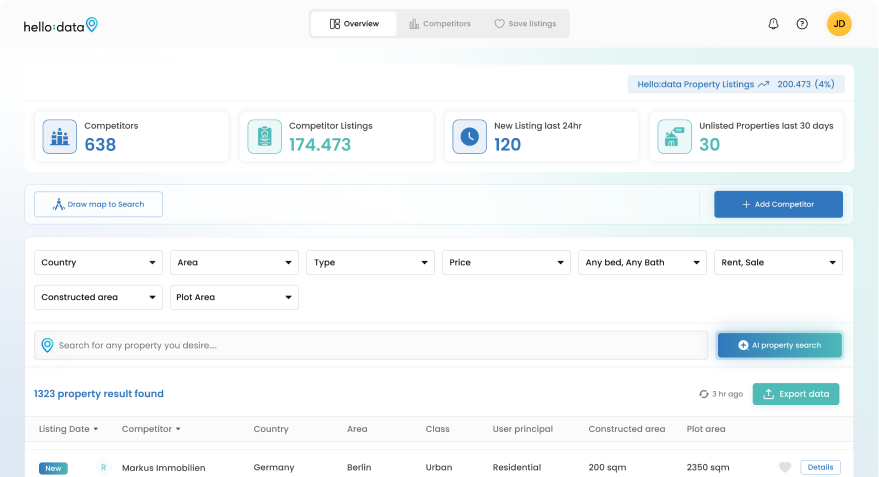

Exploring the domain of land exchanges can be overwhelming, particularly when confronted with terms like “Money to Close” and “Shutting Expenses.” These terms are indispensable parts of any property buy, and understanding the contrast between them is urgent. Whether you’re a carefully prepared purchaser or a first-time home searcher investigating the man-made intelligence property search scene, fathoming the subtleties of money necessities, charges, and exchange costs is critical. Thus, we should dive into the complexities of “Money to Close” and “Shutting Expenses” to demystify their jobs in your land process with the assistance of the hellohere application, known for being the best application for land devotees.

Delving into Cash to Close and Closing Costs in the Real Estate Realm

Understanding the nuances of **cash to close** and **closing costs** in the realm of real estate is crucial for both seasoned buyers and newcomers navigating the world of property transactions. Whether you’re utilizing the latest **AI property search** tools or relying on trusted platforms like **hellohere**, grasping the intricacies of these financial aspects is essential.

The Basics of Cash to Close and Closing Costs

At the point when we discuss **cash to close**, we are alluding to the aggregate sum of assets that a purchaser needs to bring to the end table to finish a land buy. This envelops the **closing costs** as well as the initial investment, prepaids, and credits, while deducting any sincere cash stores or bank credits. Then again, **closing costs** explicitly indicate the different charges and costs caused by purchasers and dealers during the property exchange, for example, credit beginning expenses, examination expenses, title protection, and duties.

Distinguishing Between Cash to Close and Closing Costs

It means quite a bit to take note of that while **closing costs** are a part of the **cash to close** sum, the last option addresses the extensive figure that typifies every one of the monetary commitments important to settle the arrangement. As you dive into the subtleties of your land process, understanding the change between these two terms can engage you to settle on informed choices and explore the complex scene of property buys with certainty.

Demystifying the Cash to Close Concept

Unraveling the notion of **cash to close** is fundamental for anyone delving into real estate transactions. This concept, often intertwined with **closing costs**, plays a pivotal role in the financial aspects of property purchases. Whether you are exploring properties through **AI property search** tools or leveraging platforms like **hellohere**, demystifying the essence of **cash to close** can empower you in making informed decisions.

The Breakdown of Cash to Close

At its center, **cash to close** envelops the all out amount of cash that a purchaser should bring to the end table to settle the property procurement. This sum covers the **closing costs** as well as incorporates the initial investment, prepaids, and credits. By understanding this idea completely, people can explore through the money related prerequisites of property exchanges with certainty and clearness.

Key Differences between Cash to Close and Closing Costs

It’s critical to separate between **cash to close** and **closing costs** to have a complete comprehension of the monetary commitments engaged with land bargains. While **closing costs** address the particular charges and costs caused during the exchange, **cash to close** incorporates the whole monetary bundle expected to effectively take care of business. By perceiving these qualifications, purchasers can move toward property buys with an organized monetary arrangement and an unmistakable financial plan at the top of the priority list.

Navigating Closing Costs: What You Need to Know

When it comes to **closing costs** in real estate transactions, it’s essential to have a clear understanding to navigate through this financial aspect smoothly. Whether you are utilizing **AI property search** tools or relying on platforms like **hellohere**, being aware of what constitutes **closing costs** can help you in making sound financial decisions.

Components of Closing Costs

**Shutting costs** incorporate various charges and costs that purchasers and merchants cause during a property exchange. These may incorporate advance beginning expenses, evaluation costs, title look, title protection, duties, and lawyer charges. The particular parts of **closing costs** can fluctuate in light of elements like the property area, the kind of credit, and other exchange subtleties.

Managing Your Financial Plan

Understanding the breakdown of **closing costs** permits you to design your funds successfully while participating in land bargains. By having a far reaching outline of these costs and their varieties, you can more readily plan for the monetary commitments that accompany buying or selling a property. This information engages you to financial plan shrewdly and guarantee a smooth exchange process.