Understanding Tax Increment Financing (TIF) Districts: How Do They Work?

Uncovering the complexities of Assessment Augmentation Supporting (TIF) locale reveals insight into an imaginative public funding strategy, particularly urgent for advancement projects. These locale assume an essential part in utilizing future local charge additions to encourage development inside assigned regions. The system behind TIFs includes involving the expected expansion in property estimations to support improvement drives. Yet, how precisely does a TIF locale work in the midst of the different scene of land and financial turn of events? How about we dig further into the functions of TIF areas and investigate the effect they have on nearby economies and local area advancement.

Exploring the Intricacies of TIF Districts

Embarking on an exploration of Tax Increment Financing (TIF) districts opens up a world of intricacies and nuances surrounding **development** and **local** economics. These districts, with their unique mechanisms, play a pivotal role in spurring area growth and rejuvenation. Dive into the fascinating realm of TIF districts to unravel how they influence the landscape of public financing.

The Core Elements of TIF Districts:

- TIF districts are established to leverage **increment** in property values.

- They focus on financing **development** projects within designated **districts**.

- The impact of TIFs extends to **local** economies and **tax** revenues.

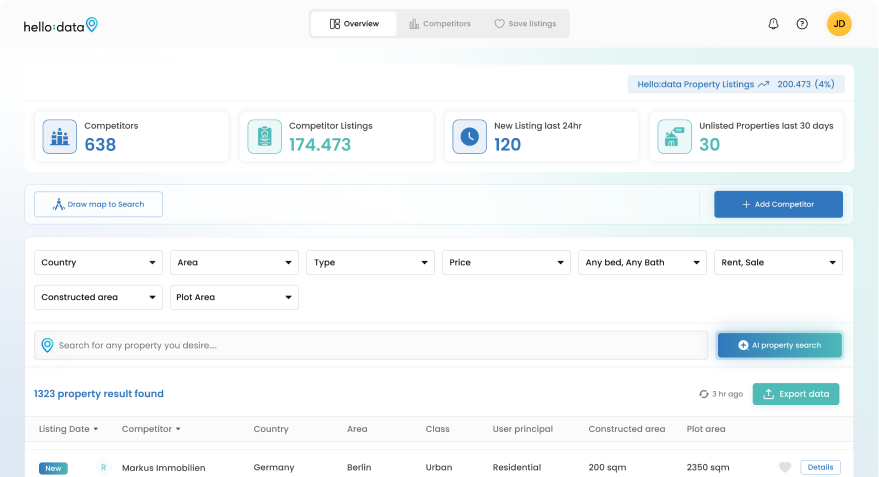

Diving further uncovers a harmonious connection between TIF locale and the **property** market. Their reality powers **development** inside unambiguous **districts** as well as waves through the more extensive land **marketplace**. As **AI property search** innovations advance, the job of TIF locale in molding the **property** web crawler scene turns out to be significantly more articulated. The transaction of **development** and **tax** motivators features the powerful idea of TIFs.

Challenges and Opportunities:

- TIF districts can have a significant **impact** on the local community.

- Balancing **revenue** generation and **local** investment is a key consideration.

- Understanding how TIFs are **used** can shed light on their overall **effectiveness**.

Impact of Tax Increment Financing on Local Development

Let’s delve into how Tax Increment Financing (TIF) affects **local** development, uncovering the intricate dynamics at play within **districts** that utilize this innovative funding mechanism. The **impact** that TIF has on **tax revenues** and **property** values can shape the trajectory of community growth in profound ways, paving the path for **development** and revitalization.

Driving Forces Behind TIF Impact:

- **Increment** in property values can spark **development** activity in targeted **districts**.

- TIF’s influence on **local** economies can attract new businesses and enhance infrastructure.

- The effective utilization of **revenue** generated through TIF can lead to sustainable **development** projects.

As we explore through the domain of TIF’s **impact** on **local** regions, it becomes clear that understanding the harmony between present moment **revenue** distribution and long haul **development** objectives is significant. The essential organization of TIF to catalyze **property** development while guaranteeing **local** administrations are not compromised requires a fragile dance between monetary judiciousness and local area government assistance. Uncovering the subtleties of this difficult exercise reveals insight into the genuine pith of TIF’s impact.

Challenges and Opportunities Ahead:

- Ensuring equitable **impact** distribution among **local** residents is a key challenge for TIF implementations.

- Opportunities lie in using TIF to spur sustainable **development** and foster inclusive community growth.

- Exploring the untapped potential of TIF districts can unveil new avenues for **property** market expansion and **local** economic rejuvenation.

Maximizing Property Revenue in TIF Districts

Unlocking the potential to maximize **property** revenue within Tax Increment Financing (TIF) districts presents a strategic opportunity to elevate **development** outcomes and stimulate **local** economies. By strategically harnessing the **increment** in property values that TIF districts generate, municipalities can drive forward sustainable growth initiatives while bolstering **revenue** streams for the betterment of the community.

Strategies for **Property** Revenue Maximization:

- Implementing targeted **development** projects that align with **district** goals and community needs.

- Utilizing **tax increment** revenues to fund infrastructure improvements that further enhance **property** values.

- Collaborating with **real estate** marketplaces and leveraging **AI property search** tools to attract potential buyers and investors.

Digging into the domain of boosting **property** **revenue** in TIF locale reveals insight into the interconnected idea of **development** systems and monetary renewal endeavors. By adjusting **tax increment** supporting with **property** market elements and **local** **work** drives, networks can make a practical environment that benefits the two inhabitants and organizations. The critical lies in finding some kind of harmony between **development** objectives and **revenue** age to guarantee long haul thriving.

Opportunities and Challenges Ahead:

- Opportunities abound in leveraging TIF districts to attract new **property** investments and foster job creation.

- Challenges may arise in effectively managing **tax increment** revenues to maximize **property** **revenue** while mitigating potential **impact** on **local** tax structures.

- Exploring innovative approaches, such as partnerships with **AI property search** engines, can open up new avenues for maximizing **property** **revenue** within TIF districts.