Understanding Defeasance: How Does a Defeasance Prepayment Penalty Work in Real Estate Loans?

Is it true or not that you are interested about how a defeasance prepayment punishment capabilities in the domain of land credits? Plunge into the complexities of defeasance, punishments, costs, protections, installment timetables, and more with a thorough manual for grasping this complex monetary idea. Whether you’re a carefully prepared financial backer or a first-time homebuyer, the instrument behind defeasance can fundamentally influence credit prepayments and monetary procedures. How about we disentangle the secret encompassing defeasance and investigate its suggestions for borrowers and banks the same.

Delving into Defeasance: A Comprehensive Guide

Exploring the world of defeasance can be like diving into a deep ocean of financial intricacies and consequences. Imagine navigating through a maze of terms like prepayment penalties, interest rates, and loan schedules. It’s like deciphering a complex code that holds the key to understanding how real estate loans work. With each step, you unravel the mystery of how defeasance reshapes the financial landscape for borrowers and lenders alike.

The Basics of Defeasance

With regards to defeasance, everything unquestionably revolves around moving the monetary weight from land resources for government-upheld protections. This interaction includes a fastidious estimation of installments, expenses, and timetables to guarantee a smooth progress. Picture a monetary difficult exercise where each move should adjust impeccably to keep up with harmony. From expenses for protections choice, everything about in the realm of defeasance.

The Impact on Borrowers and Lenders

For borrowers, defeasance can mean exploring an ocean of expenses and punishments, as they endeavor to prepay their credits while keeping up with monetary soundness. Then again, loan specialists benefit from the security of realizing their yields are safeguarded, even as borrowers look for early reimbursement. It’s a fragile dance of monetary procedures and estimations that can shape the fate of land exchanges.

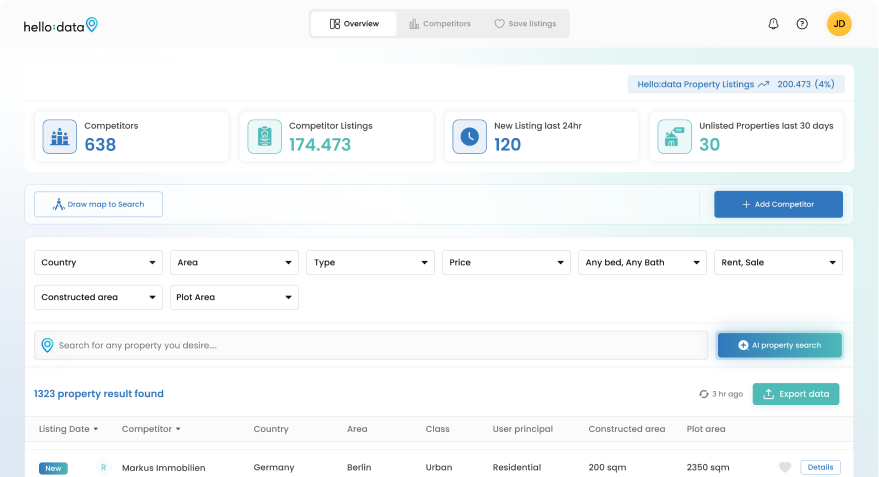

Understanding the Cost of Defeasance Prepayment Penalties

Delving into the realm of defeasance prepayment penalties necessitates a grasp on the cost implications involved. Understanding how these penalties are calculated and their impact on real estate transactions is crucial for borrowers and lenders alike. Let’s take a closer look at the financial intricacies that define the cost of defeasance prepayment penalties.

Calculating Defeasance Costs

With regards to deciding the expense of defeasance prepayment punishments, a fastidious estimation process becomes an integral factor. This includes evaluating different factors like excess advance installments, choice of suitable government protections, and thought of extra costs like lawful charges and counseling expenses. The complete expense is impacted by economic situations and current loan costs, making it a powerful monetary evaluation.

Impact on Borrowers and Lenders

The expense of defeasance prepayment punishments can have huge implications for the two borrowers and loan specialists in the domain of land supporting. For borrowers, these expenses might present monetary difficulties while looking to prepay their credits. Then again, banks benefit from the affirmation that their normal yields are secured, even in case of early advance reimbursement. Exploring the expense scene of defeasance prepayment punishments requires a cautious equilibrium of monetary contemplations for all gatherings included.

Navigating the Complexities of Securities in Real Estate Loans

When exploring the intricate world of securities in real estate loans, one must navigate through a labyrinth of financial instruments and structures. Understanding how these securities function within the realm of real estate transactions can be a daunting task for many. Let’s delve deeper into the complexities surrounding securities and their role in shaping the landscape of property financing.

Determining the Role of Securities

Protections assume a critical part in land credits, going about as a shield against likely dangers and vulnerabilities. These monetary resources give a feeling of safety to moneylenders by guaranteeing that the credit installments are upheld by steady and solid government protections. For borrowers, protections can affect the expense of prepayment punishments and impact the generally monetary design of the credit. Exploring through the subtleties of protections requires an intensive comprehension of their effect on the two borrowers and loan specialists.

Considerations for Borrowers and Lenders

For borrowers in land exchanges, protections achieve a layer of intricacy with regards to grasping the related expenses and punishments. The choice of suitable protections and the estimation of their expenses can fundamentally influence the possibility of prepaying a credit. Then again, moneylenders depend on protections to safeguard their speculations and keep a degree of monetary strength notwithstanding prepayment gambles. Effectively dealing with the complexities of protections in land credits requires a fragile harmony between borrower necessities and bank securities.