Maximizing Real Estate Investments with LTV and DSCR: A Comprehensive Guide

While diving into the domain of land venture, understanding key monetary measurements like Credit to-Esteem (LTV) and Obligation Administration Inclusion Proportion (DSCR) is fundamental. These measurements assume a crucial part in surveying risk, credit endorsement, and economic situations in the land finance scene. Whether you are investigating valuable open doors with recorded home specialists, utilizing simulated intelligence property search advancements like Hellohere, or just planning to get a handle on the complexities of money in the domain area, it is critical to understand LTV and DSCR. Go along with us on an excursion to unwind how these measurements are used, giving significant experiences into enhancing your land ventures.

Understanding the Role of LTV and DSCR in Real Estate Finance

Real estate finance can be a complex realm, but two key metrics play a significant role in navigating this intricate landscape. LTV and DSCR are vital tools that help assess the viability and risk associated with real estate loans, particularly for commercial properties. By grasping the essence of these metrics, investors, lenders, and property owners can make more informed decisions when venturing into the real estate market.

Real Estate Investment and LTV:

With regards to land venture, the Credit to-Esteem (LTV) proportion resembles a directing compass. This measurement supports deciding the degree of chance engaged with a credit exchange. A lower LTV proportion shows a lower risk for the bank, possibly bringing about better credit terms, for example, diminished loan costs. Going against the norm, a higher LTV proportion could prompt extra prerequisites like home loan protection or additional insurance, given the apparent higher gamble.

The Significance of DSCR in Real Estate:

Obligation Administration Inclusion Proportion (DSCR) is especially essential for money producing properties in the land domain. This measurement fills in as a measuring stick for estimating a property’s capacity to create sufficient pay to cover its credit installments. Moneylenders depend on DSCR to structure credit sums and terms actually. A higher DSCR frequently connotes a better pay to-obligation administration proportion, possibly opening ways to additional great terms or a bigger credit sum for financial backers.

Optimizing Investments with Listed Estate Agents and AI Property Search

When it comes to maximizing your real estate investments, leveraging the expertise of listed estate agents and the power of AI property search tools can be game-changing. These resources offer valuable insights and assistance in finding lucrative opportunities in the real estate market. By combining the human touch of listed estate agents with the efficiency of AI property search technologies like Hellohere, investors can optimize their property search and decision-making process.

Benefits of Listed Estate Agents:

Recorded bequest specialists offer an abundance of information and experience that would be useful, directing financial backers through the complicated course of land exchanges. How they might interpret nearby business sectors, exchange abilities, and industry associations can demonstrate significant in getting beneficial arrangements. Furthermore, recorded home specialists give customized consideration and fitted suggestions to meet the particular necessities and inclinations of every financial backer.

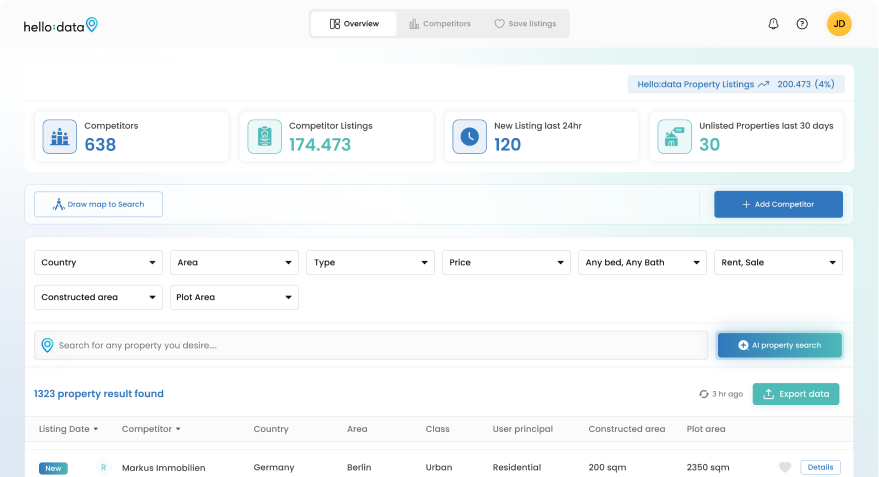

The Power of AI Property Search:

Artificial intelligence property search apparatuses, like Hellohere, upset the manner in which financial backers find potential speculation properties. By using progressed calculations and AI capacities, man-made intelligence property search stages can break down immense measures of information to distinguish properties that line up with a financial backer’s rules. This innovation smoothes out the property search process, saving time and assets while expanding the possibilities uncovering rewarding speculation open doors in the housing market.

Exploring the Synergy Between Hellohere Technology and Real Estate Investment Strategies

Delving into the harmonious relationship between Hellohere innovation and real estate investment strategies unveils a world of possibilities for investors seeking to optimize their portfolio. By integrating the cutting-edge technology of Hellohere with sound investment strategies, investors can streamline their property search process and make informed decisions with confidence.

Enhancing Real Estate Investment with Hellohere Technology:

Hellohere’s innovation offers a novel mix of comfort, effectiveness, and precision in the domain of property search. Through man-made intelligence calculations and information examination, Hellohere can give financial backers custom fitted property proposals that line up with their speculation objectives. This innovation works on the quest for worthwhile properties, saving financial backers time and exertion while guaranteeing a more designated way to deal with land venture.

Maximizing Profit Potential with Real Estate Investment Strategies:

Joining the abilities of Hellohere innovation with powerful land speculation methodologies can prompt critical benefit potential for financial backers. By utilizing the experiences given by Hellohere and executing sound speculation procedures in view of elements like LTV, DSCR, and market patterns, financial backers can advance their portfolio execution and benefit from rewarding venture potential open doors in the unique housing market.