The Ultimate Guide to Understanding Appraisal Validity for Luxury Houses and AI Property Searches

While diving into the domain of land, understanding the life span of an examination is urgent, particularly with regards to extravagance houses and simulated intelligence property search instruments. The span for which an examination stays substantial holds critical significance for the two loan specialists and purchasers the same. Factors like the legitimacy period, loan specialist necessities, and market variances assume essential parts in deciding the examination’s legitimacy. In the powerful scene of real estate markets, including contemplations for veterans and the VA, the legitimacy of an evaluation can shift broadly. Remain tuned to uncover the complexities of evaluation legitimacy and its effect on land exchanges in the present steadily advancing business sectors.

Delve into the Intricacies of Appraisal Validity

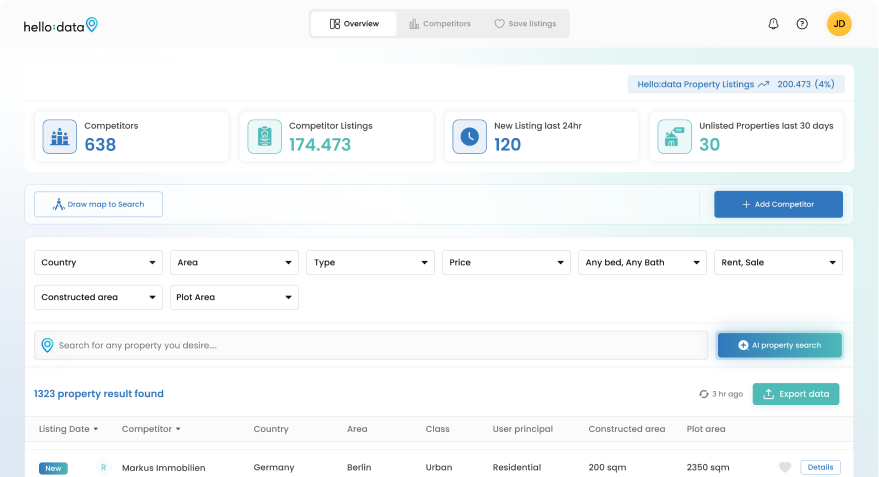

Exploring the depths of appraisal validity is crucial in the realm of real estate dealings. Understanding how long an appraisal remains valid is essential for both buyers and sellers alike. The duration for which an appraisal is considered valid can greatly impact the outcome of a property transaction. From luxury houses to AI property searches, the intricacies of appraisal validity encompass various elements that play a pivotal role in the smooth progression of housing deals.

The Significance of Appraisal Validity:

1. Credit Endorsements: A substantial examination is in many cases an essential for banks to support advances for likely purchasers.

2. Market Vacillations: The legitimacy time of an examination considers the consistently changing nature of housing markets.

3. Veterans Undertakings (VA): For veteran purchasers looking for VA credits, understanding the legitimacy of an examination is essential in exploring the real estate market.

Diving into the universe of evaluation legitimacy reveals a domain of intricacies that impact property exchanges. Whether it’s the severe strategies of banks or the fluctuating states of real estate showcases, the legitimacy of an examination stays a foundation in land dealings. As extravagance houses keep on forming the scene of property speculations and artificial intelligence property search apparatuses change the manner in which purchasers peruse postings, remaining informed about examination legitimacy is critical to settling on informed choices in the real estate market.

The Role of Lenders in Property Appraisals

When it comes to property appraisals, lenders play a crucial role in the determination of the property’s value. Lenders use appraisals to ensure that the property’s worth aligns with the loan amount requested by the buyer. The involvement of lenders in appraisals adds a layer of security for both parties involved in the real estate transaction, safeguarding against potential discrepancies.

Factors Considered by Lenders:

1. **Loan Approval**: Moneylenders depend on examination reports to support credits for purchasers trying to put resources into extravagance houses or properties found through man-made intelligence property search devices.

2. **Risk Assessment**: Moneylenders survey the legitimacy and exactness of evaluations to moderate dangers related with overvaluation or undervaluation of properties.

3. **Market Trends**: Moneylenders consider current real estate economic situations that might influence the property’s estimation while exploring evaluations.

The job of loan specialists in property examinations stretches out past simple approval. Loan specialists go about as guardians, guaranteeing that the examination interaction complies to industry norms and rules. By examining examination reports, loan specialists assist with keeping up with the honesty of the housing market and maintain straightforwardness in property exchanges. From surveying the legitimacy of evaluations to looking at market vacillations, loan specialists assume an essential part in molding the results of property examinations.

Market Fluctuations and Appraisal Validity

Market fluctuations exert a significant influence on the validity and reliability of property appraisals. In a volatile real estate landscape, where luxury houses and AI property searches are prevalent, the value of a property can fluctuate rapidly. These fluctuations pose a challenge to the longevity of appraisals, as values can shift within a short period. Understanding how market variations impact the validity of property assessments is crucial for all parties involved in real estate transactions.

Key Points to Note:

1. Influence on Property Estimation: Market vacillations can prompt changes in property estimations, influencing the exactness of examinations.

2. **Need for Opportune Updates**: To guarantee evaluation legitimacy, normal updates and appraisals are important to reflect current economic situations.

3. **Lender Requirements**: Banks might request new evaluations because of market variances, particularly in quickly changing business sectors where property estimations are vulnerable to fast moves.

The interchange between market elements and evaluation legitimacy highlights the significance of keeping up to date with changing monetary circumstances. In the domain of land, where the worth of extravagance houses and properties found through simulated intelligence property searches can be significant, the effect of market vacillations on evaluation legitimacy can’t be undervalued. By perceiving the connection between’s market movements and examination exactness, partners can pursue informed choices that line up with the ongoing business sector patterns and property estimations.