Maximizing Tax Benefits: Understanding 1031 Exchange into Opportunity Zones

Diving into the universe of land venture, the idea of consolidating a 1031 trade with an open door zone speculation can yield worthwhile duty benefits. By appreciating the subtleties of these two particular techniques, financial backers can explore the intricacies of duty deferral, gain potential, and property reinvestment. Understanding the interchange between 1031 trades and opportunity zones is significant for boosting venture returns while limiting assessment liabilities. We should investigate how joining these amazing assets can push your portfolio towards monetary achievement.

Unraveling the Tax Advantages

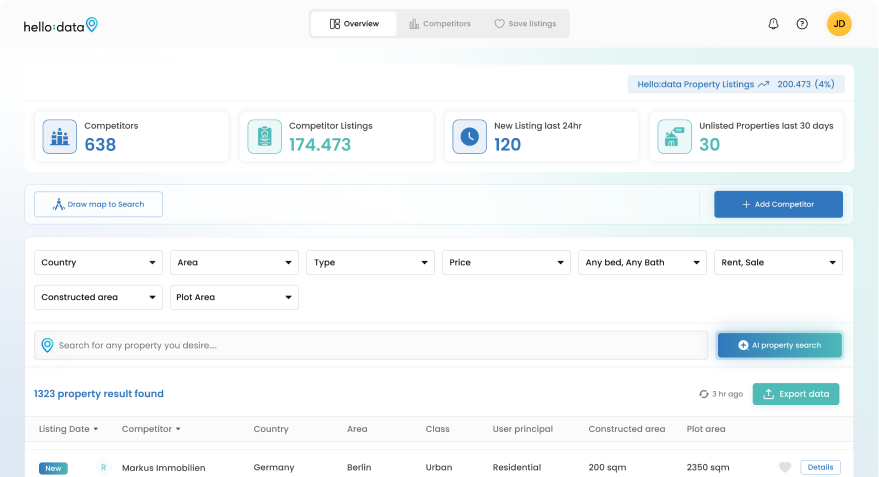

Exploring the world of tax benefits in real estate investments can be both intriguing and financially rewarding. One key strategy that savvy investors often consider is the combination of a 1031 exchange with an opportunity zone investment. This unique approach allows investors to potentially defer, reduce, or even eliminate capital gains taxes, paving the way for significant savings and increased returns on their investments.

Key Points:

- 1031 Exchange: Involves deferring capital gains taxes by reinvesting in like-kind properties.

- Opportunity Zone Investment: Offers tax benefits by investing capital gains into designated zones.

- Tax Savings: Maximizing tax advantages through strategic property reinvestment.

By decisively using a 1031 trade to obtain property inside an open door zone, financial backers can profit by charge motivations while enhancing their portfolios. This approach gives quick duty alleviation as well as opens up open doors for long haul abundance collection. Understanding the complexities of expense benefits in land can engage financial backers to pursue informed choices and upgrade their monetary results.

Navigating Opportunity Zone Investments

Delving into the realm of opportunity zone investments can offer a treasure trove of potential benefits for astute investors. Navigating the intricacies of these investments requires a keen understanding of how capital gains can be reinvested to unlock tax advantages and foster long-term wealth accumulation. By strategically directing investments into qualified funds operating within opportunity zones, investors can tap into a wealth of tax incentives and financial rewards.

Key Considerations:

- Qualified Opportunity Funds: Channeling capital gains into designated funds for tax benefits.

- Tax Deferral: Postponing capital gains taxes for potential future savings.

- Wealth Growth: Leveraging opportunity zone investments for sustained wealth accumulation.

By proactively participating in open door zone speculations, financial backers can broaden their portfolios as well as gain by charge proficient systems to improve their monetary returns. These ventures present a novel road for creating financial stability while at the same time adding to the monetary development of assigned regions. The productive blend of duty benefits and land open doors can prepare for a prosperous speculation venture.

Strategic 1031 Exchange Approach

When it comes to executing a strategic 1031 exchange approach, investors have the opportunity to capitalize on tax-deferred benefits while optimizing their real estate portfolios. By leveraging the flexibility of a 1031 exchange, individuals can seamlessly transition their investment properties, potentially deferring capital gains taxes and preserving more of their profits for reinvestment. This approach requires meticulous planning and adherence to IRS guidelines to ensure a smooth and compliant exchange process.

Key Strategies:

- Property Identification: Selecting suitable like-kind properties for a successful exchange.

- Timely Transactions: Meeting IRS deadlines for property identification and acquisition.

- Expert Guidance: Seeking advice from tax professionals and advisors for optimal exchange outcomes.

By decisively exploring the subtleties of a 1031 trade, financial backers can open a bunch of advantages, including charge deferral and portfolio enhancement. This approach offers a proactive technique for expanding venture returns and encouraging long haul monetary development. Understanding the significance of timing and property determination is essential in executing a consistent 1031 trade that lines up with speculation objectives and monetary goals.