Optimizing Multifamily Revenue: A/B Testing Pricing Strategies for Property Managers

In the domain of multifamily income the executives, the act of A/B testing estimating methodologies has arisen as an important device for property supervisors trying to streamline their benefits. By exploring different avenues regarding different sticker costs, administrators of multifamily properties can evaluate market interest, check inhabitant inclinations, and amplify income potential. This strategy, frequently alluded to as A/B testing, includes testing varieties of valuing to decide the best methodology for a given property. Through this information driven procedure, administrators can settle on informed choices to upgrade income age and draw in planned occupants effectively.

Exploring A/B Testing in Multifamily Revenue Management

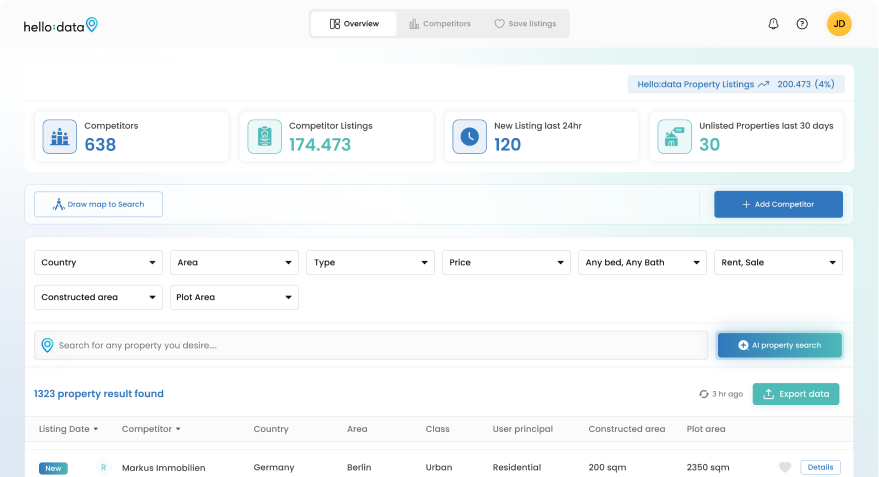

When delving into the realm of A/B testing within the sphere of multifamily revenue management, one encounters a fascinating method employed by property managers to optimize their strategies. It involves comparing different pricing approaches to determine the most effective one for their multifamily properties. This technique, commonly known as A/B testing, allows managers to assess market dynamics, understand tenant preferences, and ultimately enhance revenue streams.

The Importance of A/B Testing:

- Market Insights: A/B testing provides property managers with valuable insights into market demand and pricing trends. By experimenting with different price points, managers can gauge the responsiveness of potential tenants and adjust their strategies accordingly.

- Tenant Satisfaction: Understanding tenant preferences is crucial for retaining residents in multifamily properties. A/B testing helps managers tailor pricing models to meet the needs and expectations of their tenants, fostering better tenant satisfaction and loyalty.

- Revenue Optimization: By continuously testing and analyzing pricing strategies, property managers can identify the most lucrative pricing points that maximize revenue generation. This data-driven approach enables managers to make informed decisions that positively impact their bottom line.

All in all, A/B testing fills in as an integral asset for property chiefs trying to calibrate their income the executives techniques in multifamily properties. By outfitting the bits of knowledge gathered from A/B testing, chiefs can adjust to dynamic economic situations, upgrade occupant encounters, and eventually improve income streams for long haul achievement.

Maximizing Revenue Through Pricing Strategies

When it comes to maximizing revenue through pricing strategies in the realm of multifamily properties, savvy managers are constantly seeking ways to enhance their income streams. Effective pricing strategies play a crucial role in attracting tenants, optimizing occupancy rates, and ultimately boosting profitability. By leveraging A/B testing methodologies, managers can fine-tune their pricing approaches to achieve optimal financial outcomes.

Key Strategies for Revenue Maximization:

- Dynamic Pricing: Implementing dynamic pricing models based on seasonality, market demand, and other factors can help maximize revenue potential for multifamily properties.

- Targeted Marketing: Tailoring pricing strategies to target specific tenant demographics or market segments can lead to increased tenant interest and higher occupancy rates.

- Data-Driven Decisions: Utilizing data analytics to analyze pricing trends, market dynamics, and tenant behavior can enable managers to make informed decisions that enhance revenue generation.

By taking on a proactive way to deal with estimating procedures, property directors can make an upper hand in the multifamily property market. The capacity to adjust evaluating structures in light of economic situations, occupant inclinations, and industry patterns permits chiefs to remain on the ball and boost income potential. Through a mix of A/B testing, information investigation, and vital direction, supervisors can open new open doors for income development and long haul achievement.

Understanding the Impact on Multifamily Properties

Understanding the impact of pricing strategies on multifamily properties is essential for property managers looking to optimize their revenue. By delving into the world of A/B testing and experimenting with different pricing models, managers can assess how these strategies influence tenant behavior, market demand, and overall financial performance. This knowledge allows managers to make data-driven decisions that maximize revenue potential and ensure the long-term success of their properties.

Key Factors Influencing Multifamily Properties:

- Tenant Engagement: Pricing strategies can directly impact tenant engagement levels, affecting occupancy rates and tenant retention in multifamily properties.

- Competitive Positioning: Adopting effective pricing strategies can help multifamily properties stand out in a competitive market, attracting more tenants and maximizing revenue potential.

- Financial Performance: The implementation of strategic pricing models can significantly impact the financial performance of multifamily properties, enhancing profitability and sustainability.

By recognizing the significance of evaluating procedures in the multifamily property area, directors can use A/B testing methods to acquire important experiences into market elements and occupant inclinations. This experimental methodology empowers supervisors to calibrate their evaluating systems, adjust to changing economic situations, and at last drive income development. Through a blend of market information, information examination, and key direction, property chiefs can explore the intricacies of the multifamily property market with certainty and capability.

Optimizing Pricing for Property Manager Success

Optimizing pricing strategies is a fundamental aspect of achieving success for property managers in the multifamily industry. By utilizing A/B testing techniques and analyzing pricing data, property managers can fine-tune their approach to pricing multifamily properties effectively. This process helps managers attract the right tenants, maximize revenue potential, and ultimately drive overall success in property management.

Strategies for Success:

- Market Analysis: Conducting thorough market analysis helps property managers understand market trends, competitor pricing, and tenant preferences, allowing for strategic pricing adjustments.

- Tenant Targeting: Tailoring pricing strategies to specific tenant demographics or market segments can enhance tenant interest, increase occupancy rates, and boost revenue generation.

- Continuous Evaluation: Implementing a system of continuous evaluation and adjustment based on A/B testing results ensures that pricing strategies remain optimized and aligned with market demand.

By zeroing in on advancing valuing techniques, property chiefs can situate themselves for outcome in the serious multifamily market. Utilizing A/B testing techniques and information driven experiences empowers directors to go with informed choices that drive income development and improve generally property execution. Through a blend of key estimating, market examination, and occupant commitment, property directors can open new open doors for progress and economical business development.

Testing Strategies for Enhanced Revenue Generation

Testing strategies are instrumental in enhancing revenue generation for property managers operating in the multifamily sector. Through the implementation of A/B testing methods, managers can experiment with different pricing structures to identify the most effective approaches for maximizing revenue. By understanding the impact of pricing on market dynamics and tenant behavior, managers can refine their strategies to optimize revenue streams and achieve long-term success in property management.

Effective Revenue Enhancement Techniques:

- Data-Driven Decisions: Leveraging data analytics to make informed decisions regarding pricing strategies can lead to enhanced revenue generation and improved financial performance.

- Market Adaptation: Adapting pricing strategies based on market trends, competitor analysis, and tenant feedback can help property managers stay ahead of the curve and generate increased revenue.

- Tenant Satisfaction: Prioritizing tenant satisfaction through competitive pricing can lead to higher tenant retention rates, increased occupancy, and ultimately, enhanced revenue streams.

By integrating testing procedures into their estimating philosophies, property chiefs can acquire significant experiences into the multifamily property market and upgrade their income producing potential. Using A/B testing methods, information examination, and key dynamic enables chiefs to adjust to changing economic situations, meet occupant inclinations, and drive income development. Through a precise way to deal with testing and refining estimating methodologies, property chiefs can accomplish improved income age and feasible progress in the multifamily property area.